At what point do you have too much data – the viability issue

Data could be seen as the latest form of wealth, yet an excess of something beneficial can transform a precious asset into a costly liability.

Data could be seen as the latest form of wealth, yet an excess of something beneficial can transform a precious asset into a costly liability.

Marketing’s transformation is perpetual and rivalry intense. Adopting disorder could be the secret to achieving strategic triumph. Introduce chaos theory, a scientific idea that appears

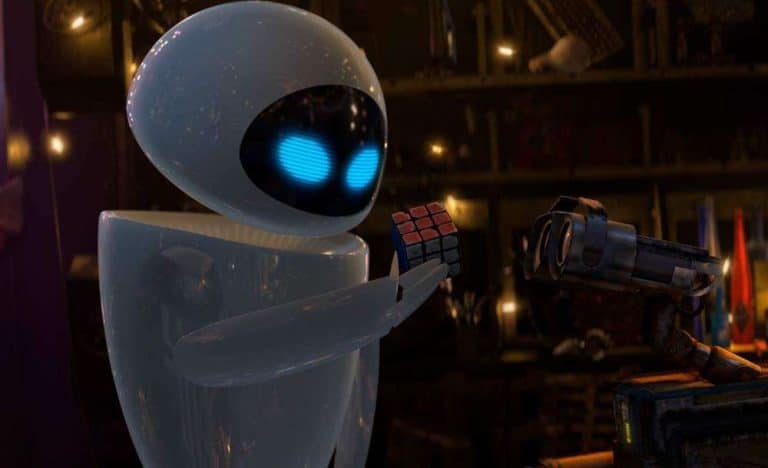

Understanding the wants and needs of consumers — ideally, before they even know it — remains a constant necessity for advertisers. Artificial intelligence (AI) is

In a time when information is constantly being created from all online activities, machine learning (ML) has become a powerful tool for making sense of

Content marketing focuses on creating and distributing useful, pertinent material to engage with your target market. The goal is to grab their interest maintain it

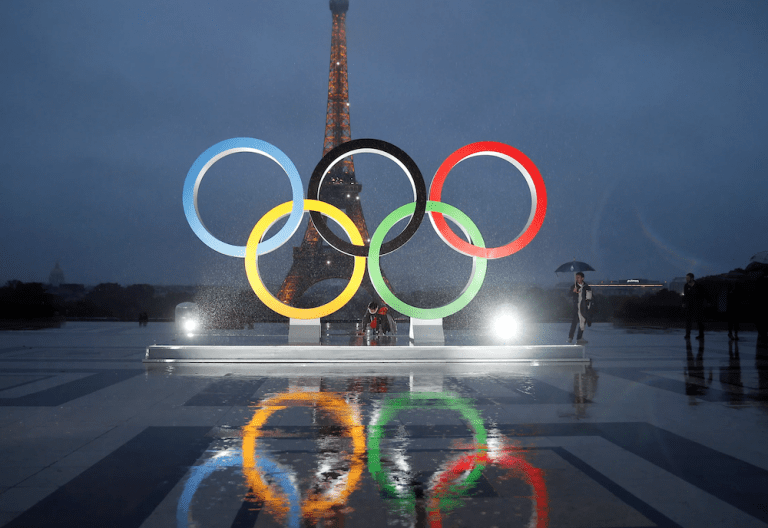

France is about to become the focus of the world, as the Olympic stars shine, as it will for any brands that have backed the

If you’re in charge of buying business software, IT, or backing a group interested in understanding the value of technology. You’re likely to be familiar

The battle for online shopping supremacy is fierce, and running an ecommerce venture is a challenge. An ecommerce business owner must juggle numerous factors to

In 2023, ecommerce companies in the UK generated a total revenue of over $130 billion. Moreover, ecommerce sales are expected to grow by 4.1% in

Looking into the next 12 months, the fashion ecommerce world promises a dynamic mix of change and creativity. As technology and what customers want keep

By 2028, Gartner, Inc. predicts that one-third of engagements with generative AI (GenAI) services will involve the use of action models and self-operating agents for

Email marketing attribution involves gathering information to figure out if an email played a role in a transaction, such as a purchase, signing up for

Artificial Intelligence has gradually integrated into our daily experiences, from the generative AI technology that operates our mobile devices, to self-driving cars, to the instruments

The worldwide market for artificial intelligence (AI) is expanding at an astonishing pace, forecasted to hit $1.8 trillion by 2030, with an average growth rate

Recent reach into the winners at ecommerce reveals the significant progress made by UK ecommerce in the last four years. It’s anticipated that store visits

Large language models (LLM) is a form of artificial intelligence (AI) software capable of identifying and producing text, among various other functions. These models are

I n our rapidly moving world, artificial intelligence (AI) is increasingly a part of our everyday routines. From chatbots to forecasting systems, AI is transforming

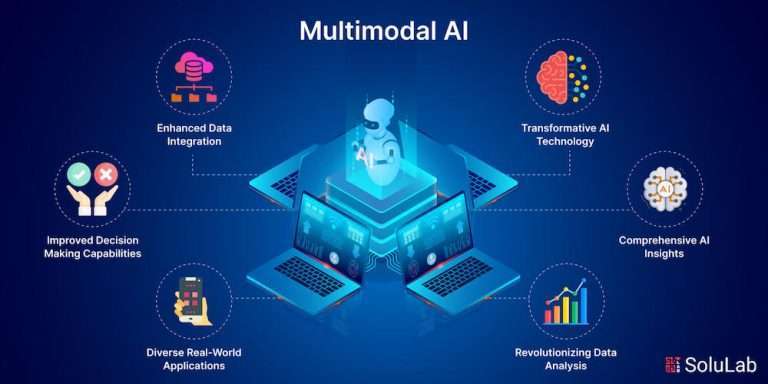

In the constantly changing world of AI, the development of multimodal models represents a major advancement. These models, able to analyse and comprehend information from