Enterprise resource planning (ERP) refers to a type of software that organisations use to manage day-to-day business activities such as accounting, procurement, project management, risk management and compliance, and supply chain operations. A complete ERP suite also includes enterprise performance management, software that helps plan, budget, predict, and report on an organisation’s financial results.

ERP systems tie together a multitude of business processes and enable the flow of data between them. By collecting an organisation’s shared transactional data from multiple sources, ERP systems eliminate data duplication and provide data integrity with a single source of truth.

Today, ERP systems are critical for managing thousands of businesses of all sizes and in all industries. To these companies, ERP is as indispensable as the electricity that keeps the lights on.

What is an ERP system?

How can these solutions manage organisations’ day-to-day business activities, such as accounting, finance, procurement, project management, supply chain, and manufacturing?

Enterprise resource planning systems are complete, integrated platforms, either on-premises or in the cloud, managing all aspects of a production-based or distribution business. Furthermore, ERP systems support all aspects of financial management, human resources, supply chain management, and manufacturing with your core accounting function.

ERP systems will also provide transparency into your complete business process by tracking all aspects of production, logistics, and financials. These integrated systems act as a business’s central hub for end-to-end workflow and data, allowing a variety of departments to access.

ERP Systems and software support multiple functions across the enterprise, mid-sized, or small businesses, including customizations for your industry.

What’s the difference between ERP and financials?

Although the term “financials” is often used when describing ERP software, financials and ERP are not the same thing. Financials refers to a subset of modules within ERP.

Financials are the business functions relating to the finance department of an organisation and includes modules for financial accounting, sub ledger accounting, accounting hub, payables and receivables, revenue management, billing, grants, expense management, project management, asset management, joint venture accounting, and collections.

Financial software uses reporting and analytical capabilities to comply with the reporting requirements of governing bodies, such as the International Financial Reporting Standards Foundation (IFRS), Financial Accounting Standards Board (FASB) for Generally Accepted Accounting Principles in the United States (GAAP), as well as for other countries (HGB in Germany and PCG in France, for example).

For public organisations, financial software has to be able to produce periodic financial statements for governing regulators, such as the US Securities and Exchange Commission (SEC) (with reports such as quarterly 10-Q and annual 10-K), European Securities and Markets Authority (ESMA), and others. For these types of financial reports, a narrative reporting tool is used. The person who is ultimately responsible for financials is the CFO.

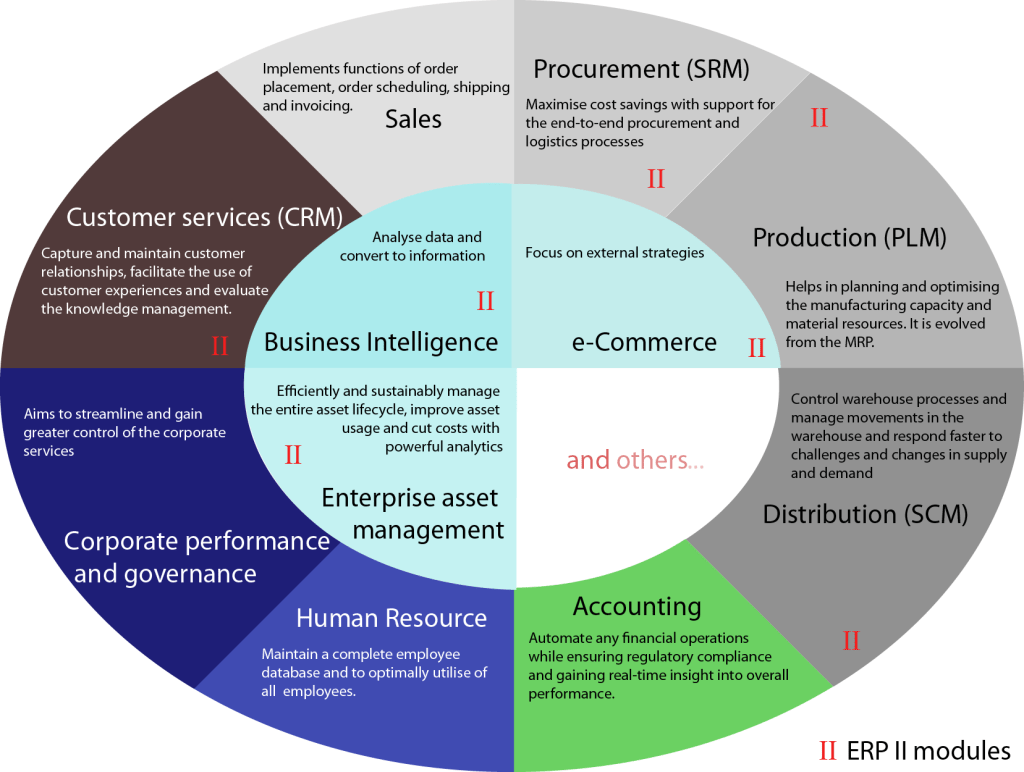

While financials handle one area of the business, ERP encompasses a wide range of business processes—including financials. ERP software can include capabilities for procurement, supply chain management, inventory, manufacturing, maintenance, order management, project management, logistics, product lifecycle management, risk management, enterprise performance management (EPM), and human resources/human capital management.

ERP also integrates with front-office applications to build holistic views of customers, including customer relationship management (CRM) solutions. Additionally, cloud-based ERP applications are often embedded with next-generation technologies, such as the Internet of Things (IoT), blockchain, AI, machine learning, and digital assistants.

These advanced technologies deliver data and capabilities that not only enhance many traditional ERP functions; but they create new opportunities for increased efficiencies, new services, and deeper insight across an enterprise. Since ERP systems are comprehensive across an enterprise, their management often involves a partnership with the CFO as well as the CIO, COO, and other key executive leaders.

Cloud-based ERP applications are often embedded with next-generation technologies, such as the Internet of Things (IoT), blockchain, AI, machine learning, and digital assistants.

ERP fundamentals

ERP systems are designed around a single, defined data structure (schema) that typically has a common database. This helps ensure that the information used across the enterprise is normalized and based on common definitions and user experiences.

These core constructs are then interconnected with business processes driven by workflows across business departments (e.g. finance, human resources, engineering, marketing, and operations), connecting systems and the people who use them. Simply put, ERP is the vehicle for integrating people, processes, and technologies across a modern enterprise.

For example: consider a company that builds cars by procuring parts and components from multiple suppliers. It could use an ERP system to track the requisition and purchase of these goods and ensure that each component across the entire procure-to-pay process uses uniform and clean data connected to enterprise workflows, business processes, reporting, and analytics.

When ERP is properly deployed at this automotive manufacturing company, a component, for example, “front brake pads,” is uniformly identified by part name, size, material, source, lot number, supplier part number, serial number, cost, and specification, along with a plethora of other descriptive and data-driven items.

Since data is the lifeblood of every modern company, ERP makes it easier to collect, organize, analyze, and distribute this information to every individual and system that needs it to best fulfil their role and responsibility.

ERP also ensures that these data fields and attributes roll up to the correct account in the company’s general ledger so that all costs are properly tracked and represented. If the front brake pads were called “front brakes” in one software system (or maybe a set of spreadsheets), “brake pads” in another, and “front pads” in a third, it would be tough for the automotive manufacturing company to figure out how much is spent annually on front brake pads, and whether it should switch suppliers or negotiate for better pricing.

A key ERP principle is the central collection of data for wide distribution. Instead of several standalone databases with an endless inventory of disconnected spreadsheets, ERP systems bring order to chaos so that all users—from the CEO to accounts payable clerks—can create, store, and use the same data derived through common processes.

With a secure and centralized data repository, everyone in the organisation can be confident that data is correct, up-to-date, and complete. Data integrity is assured for every task performed throughout the organisation, from a quarterly financial statement to a single outstanding receivables report, without relying on error-prone spreadsheets.

The business value of ERP

It’s impossible to ignore the impact of ERP in today’s business world. As enterprise data and processes are corralled into ERP systems, businesses can align separate departments and improve workflows, resulting in significant bottom-line savings. Examples of specific business benefits include:

- Improved business insight from real-time information generated by reports

- Lower operational costs through streamlined business processes and best practices

- Enhanced collaboration from users sharing data in contracts, requisitions, and purchase orders

- Improved efficiency through a common user experience across many business functions and well-defined business processes

- Consistent infrastructure from the back office to the front office, with all business activities having the same look and feel

- Higher user-adoption rates from a common user experience and design

- Reduced risk through improved data integrity and financial controls

- Lower management and operational costs through uniform and integrated systems