There is no better place to start when considering ecommerce trends than a recent poll by Boston Consulting Group (BCG) shows that more than 75% of UK consumers remain concerned about inflation and recession, with 84% worried about current price increases, revealing Jessica Frame, BCG’s managing partner for the UK, predicts that shoppers will still be inhibited next year as a result, particularly for non-essential items.

But 2024 is also set to bring opportunities as retailers look to harness new technologies, embrace innovation with new consumer experiences and grow revenue streams in areas.

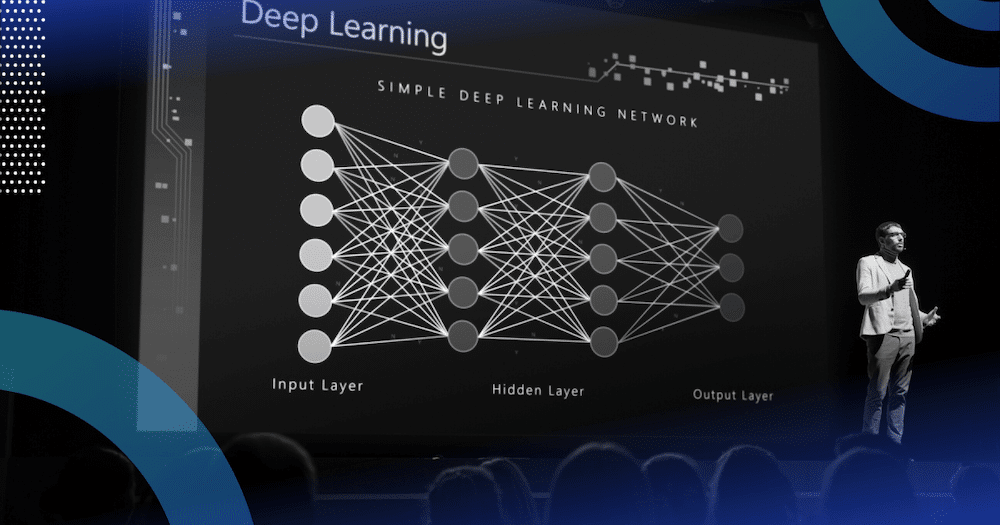

Years of AI investment will start to pay off

AI in retail – which includes machine learning, chatbots, swarm intelligence, natural-language processing and image and video analytics – is expected to reach $24.1bn by 2028. Experts predict its impact will grow significantly in 2024, increasing hyper-personalisation and more seamless customer journeys to boost the brand experience.

“Even as a back-office tool, AI will benefit the customer experience and raise the bar for what shoppers [can] expect,” says Vicky Bullen, CEO of global brand and design agency Coley Porter Bell.

Advancements in AI and ML will offer shoppers access to new experiences that are built on deep customer understanding, says Alex Tanner, senior consultant at brand consultancy Interbrand. By this time next year, he says, we can expect human-like chatbot shopping assistants that will tell you if something suits you, and then offer hyper-personalised recommendations to target you with the most tempting deal.

There’s a big market for resale and at the luxury end it’s an entry point, especially for younger customers

The AI revolution hasn’t happened overnight – more than 75% of fashion retailers have invested in the technology since 2021. But Tanner predicts the results of this R&D are about to hit the mainstream.

Julian Skelly, managing partner for retail at Publicis Sapient, says that shopping assistants will also provide grocers with a unique opportunity. AI bots will direct customers to new brands, products and ingredients based on their dietary preferences, budget and lifestyle. These channels will also boost the power of their retail media networks with more data.

But the results of AI are only as good as the data it has. To collect more data about customers, as well as digital interactions, retailers will be able to watch customers in physical stores, too, looking at their facial expressions when something is tried on, explains Tanner. Technology may even, he says, allow retailers to identify what customers are wearing, where they likely bought it and what they paid for it.

But he warns: “The promise to shoppers is better deals. A more engaging experience, perhaps? But will we be willing to pay the price with our data? Will we have a choice? All this will play out in 2024.”

Retailers will push the boundaries of in-store experiences

Customer loyalty is a rarity, so retailers need to maximise the impact of their brand experience through all channels in 2024, says Bullen.

“The in-store experience will be essential,” she explains. “But with retailers reducing their estate portfolios, brands will need to do more with those precious few spaces. Even digital brands are exploring the value of a physical experience – we’ve seen Shein announcing pop-ups and more will follow,” she adds.

And new in-store technology that enhances this customer experience – such as self-service checkouts – will be expanded further, predicts Jack Stratten, head of trends at retail consultancy Insider Trends.

He explains: “Uniqlo and Zara have self-checkout experiences that are proven to work from the customer and business point of view.

“With that technology becoming cheaper to implement, we’ll see self-checkout grow massively next year. We’ll also start to see it in sectors beyond grocery and fast fashion. Anywhere there are queues, this tech can make a difference,” he adds.

Technology will also bring the physical store experience into people’s homes in ways we’ve not seen before, says Rosh Singh, managing director, of EMEA, for digital experiences agency UNIT9.

While we might feel jaded by the metaverse hype that dominated 2022, Singh says the long-awaited ‘spatial revolution’ looks to be finally here. He points to Meta’s release of the Quest 3 headset and Apple’s announcement of its Vision Pro, a trailblazer in ‘mixed reality’.

“Imagine transforming consumers’ living rooms into interactive and fully shoppable flagship stores,” Singh says. “Spatial computing creates scalable brand experiences with virtual try-ons, hyper-personalisation and a seamless purchase experience.”

2024 will see the rise of ecommerce

Although retailers will focus on using new technologies to enhance customer experience, they’ll also be looking at new business models to grow revenue. Stratten predicts a “resale boom” in 2024 as retailers further expand into ecommerce.

Selfridges wants half of its sales to be from resale, repair, rental or refills by 2030. H&M and Uniqlo have dedicated more floor space to rental and resale initiatives. And demand is growing for resale marketplace sites such as Vinted, Vestaire and Depop.

In 2024, ecommerce will be a profit-driver, not a supplementary sustainability initiative, says Leon Bailey-Green, founder of Upper Clash and Retsre. He expects to see more retailers starting to strategically incorporate ecommerce into long-term plans.

“The retail industry generally operated on a ‘make it, sell it’s cycle. But we will witness a shift as all retailers and brands allocate a portion of their revenue to ecommerce, spurred by factors such as legislation, competition and growing customer demand,” he adds.

A recent study by Barclaycard Payments shows that ecommerce contributes nearly £7bn to the UK economy. More than four in 10 (44%) consumers buy more second-hand items than they did a year ago. “There’s a big market for resale and at the luxury end it’s an entry point, especially for younger customers who are interested in luxury but don’t yet have the disposable income. Resale isn’t a new trend, but it’s about to explode,” he adds.

Retail media networks will provide new sources of ad revenue

Skelly also predicts that successful retail media networks (RMNs) will grow in popularity, become increasingly sophisticated and drive profitability in 2024.

Retailers with strong loyalty programmes and high-volume traffic are capitalising on their first-party data by offering advertising opportunities to brands through RMNs. Skelly predicts that RMNs will become “increasingly standardised” in 2024, with more retailers taking advantage of this high-margin channel.

“We’ll see partnerships and consolidation into larger networks and a trend to break out of traditional CPG relationships to more customer-focused propositions. By following these strategies, retailers can add a new high-margin channel to their digital business, positioning for more sustainable, long-term success,” he says. Looking forward, 2024 provides an opportunity to switch focus to a retail media profitability play that also drives customer lifetime value, he says.

Maren Seitz, senior director at data analytics consultancy Analytic Partners, agrees. “Retail media networks are set to take centre stage in the ever-changing retail and ecommerce landscape in 2024. Their enhanced offering with better and faster data, which is expected to continue their momentum from this year, will allow brands to integrate retail media more seamlessly within their broader marketing mix,” he says.

Despite the challenging economic climate, retailers that embrace innovation and new technology in 2024, while exploring revenue-boosting areas, could be well placed to ride out any short-term turbulence and come out of it stronger on the other side.