With people spending more time online, social commerce offers retailers a chance to target customers on the channels where they’re spending so much of their day and reflect new customer expectations for convenience.

Social commerce blends ecommerce and social media practices and offers brands a relevant way to engage with customers, whilst offering convenience and driving sales. According to research from Bazaarvoice, one in three shoppers globally has made a purchase on social media in the past year.

Jim Herbert, vice president and general manager of EMEA at leading global Open SaaS ecommerce platform BigCommerce shares his thoughts on the rise of social commerce, and how companies can balance the use of social channels with other marketplaces to optimise their ecommerce strategies.

The successes of social commerce in omnichannel marketing

In social commerce, the entire shopping experience from product discovery to checkout can take place within the social media platform. Brands all around the world are tapping into its potential to redefine the shopping experience and meet new customer expectations with convenience and simplicity. For example, in 2019, tequila brand Patron became the first liquor brand to enable customers to order directly from Instagram using the in-app checkout feature.

However, whilst social commerce can be an excellent opportunity for many brands, knowing your audience is key. Research from eMarketer suggests the rise of social commerce has very much been driven by younger consumers, as they look for more personalised shopping experiences.

TikTok for example is rapidly gaining popularity as a sales platform, as I’ve seen from the recent round of 18th birthdays my daughter has been privy to. And this phenomenon now has its hashtag – #TikTokMadeMeBuyIt. Now with more than 2.3B views of the hashtag, influencers on the app are going as far as creating content solely based on online shopping.

As the demand for rich visual content is high on these platforms, brands that have products they can showcase using visual elements are more likely to enjoy success using social commerce, than those without. A Facebook-developed case study on country fashion brand Barbour shows the retailer has also seen Instagram sales increase by 42% since implementing the feature.

According to Initials, the price of items also seems to be a determining factor. Research suggests that big-ticket items such as travel and luxury are less popular choices for purchase on social media platforms than more affordable items. To understand when and where to implement a social commerce strategy, brands must fully understand their target markets and the patterns of consumer behaviour.

The future of social commerce in omnichannel marketing

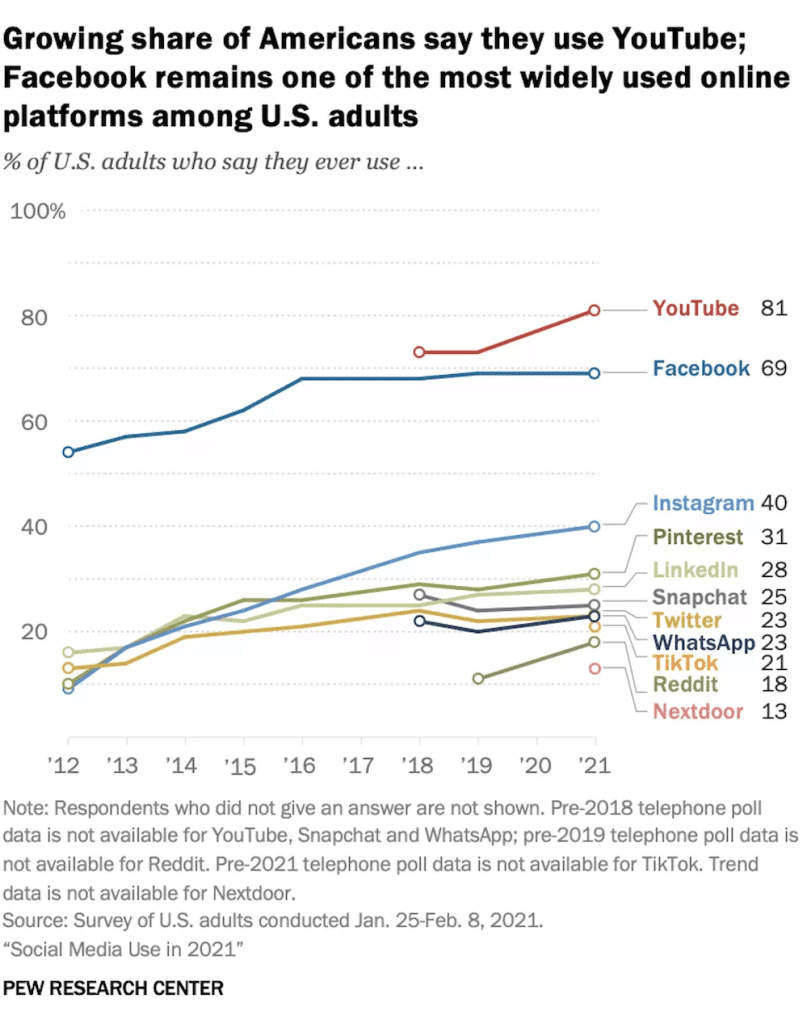

Around 51% of US social media users had considerably increased their social media use by mid-2020. The rise in the amount of time spent on social media coupled with increased reliance on online shopping has contributed to the rapid rise of social commerce.

eMarketer forecasts that the US social commerce market will grow by around 34.8% in 2021. As such, social commerce looks poised to have a significant impact on the way we browse and shop through its ability to create a more streamlined and personalised shopping experience.

Elsewhere, social commerce has played a significant role in shopping experiences and is increasingly influential in driving sales and influencing consumers. One example is Singles Day in China, now the biggest online shopping experience in the world. Last year’s event generated $72.11 billion in sales on Alibaba’s Tmall and sales on JD.com also rose by 32.8% compared to 2019, as retailers in the country continued to tap into Chinese consumers’ increasing social commerce capabilities.

Naturally, as social media use grows, the opportunities for social commerce will also increasingly come to fruition. A major indicator of potential growth is how all major social media platforms continue to enhance their ecommerce capabilities. Facebook and Instagram shops, as well as TikTok and Pinterest catalogues, have all been put in place to deliver an in-app ecommerce experience for users. According to a 2019 letter to investors, Deutsche Bank believes the check-out functionality on Instagram could add $10 billion worth of revenue to Facebook in 2021.

Looking ahead

As the customer journey continues to become more dynamic, there is an increased need for brands to identify what combination of marketplaces and platforms makes the most sense for their specific business and audience. According to the NRF’s Winter 2020 Consumer View, 83% of shoppers say convenience while shopping is more important now compared to five years ago. Retailers today must deliver a more resonant brand and better shopping experience to stay ahead of the competition.

Adopting an omnichannel approach which integrates the in-store and social platform experience can help mitigate some of the limitations of social commerce and enhance customer satisfaction. This strategy also allows retailers to target customers across all the channels and touchpoints they frequent and improve their overall shopping experience.

A full list of all our articles is available via the link.