With ecommerce surging, building direct-to-consumer capabilities is more important than ever—but how do companies truly scale their D2C business? Direct-to-consumer (D2C) ecommerce currently presents the best opportunity for innovative brands to build direct relationships with their customers. D2C refers to the practice of selling a product directly to the consumer via a company’s web store, thus bypassing third-party retailers or wholesalers. For companies, building D2C ecommerce capabilities allows them to directly interact with their end-consumers, which helps steer brand strategy and innovation based on real-time consumer insights.

These insights can help a company answer consumer needs directly, thereby maximizing both consumers’ commitment to the brand and their lifetime value. With the ever greater appreciation of individualisation (nee hyper-personalisation) within ecommerce, the retailer needs to appreciate the need to meet the relevance of your products to the consumer, not the other way around, now acknowledged to be far more lucrative than chasing loyalty.

Building a D2C business may be easier for some, as companies differ in terms of their history in direct selling, as well as the attractiveness of their brand and category for direct sales. However, companies of all kinds and sizes have been able to make use of D2C ecommerce by scaling their capabilities, or by accessing capabilities such as marketplaces, ready-to-use platforms, and software as a service (SaaS) that facilitate access to the online channel.

This article focuses on the management shifts required for any company trying to move from existing D2C to “breakthrough” D2C—by which we mean moving away from consistent double-digit growth on a small base to 2–3x the growth, or from say $100 million to over $1 billion revenue.

To do so, it is vital to understand why some companies can implement and grow D2C ecommerce to become an integral part of their operations, while others see limited growth. We explore the factors that may prevent success, as well as actions certain brands have taken to break through these barriers. These include well-known leaders in D2C ecommerce such as Nike, but also consumer-electronics companies like Lenovo. We focus on industries for which D2C ecommerce is of particular interest because of their ability to build brand affinity, and the propensity of shoppers to shop these categories online. Examples include consumer electronics, luxury goods, fashion and apparel.

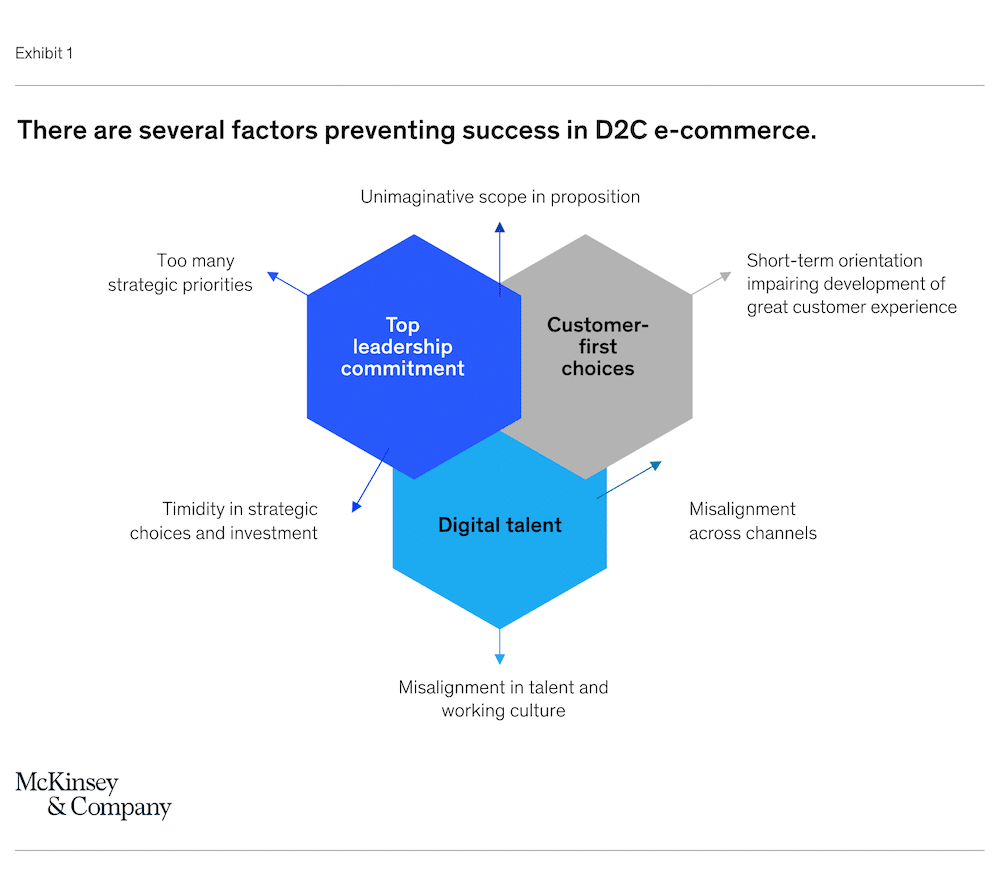

Factors Preventing Growth in Ecommerce Success in D2C

Our review of leading D2C companies found that factors for success or failure can be categorised by three core elements: top leadership commitment, customer-centricity, and digital talent. Within these, we identified three “individual” and three “overlapping” factors that collectively determine whether companies manage to implement and grow D2C ecommerce.

Too many strategic priorities

A lack of prioritisation of D2C by top leadership can often lead to D2C being treated as an afterthought, especially if leadership pursues too many strategic priorities. Lack of prioritisation of D2C compared to other areas tends to prevent “breakthrough” decisions are being made, and can amplify the other factors preventing success.

Timidity in strategic choices and investments

Brands can make the mistake of attempting to implement a multitude of fragmented D2C ideas and solutions—for example, by using the D2C platform for both brand-building and sales growth in a nonintegrated way, managed by different teams. As a result, new initiatives and investments are justified incrementally in the standard business-planning process, leading to slow progress, which in turn limits buy-in for faster and greater investment, creating a vicious, self-perpetuating cycle.

Misalignment across channels

To grow a new channel, existing channels must often be disrupted. For D2C, the fear of upsetting channel partners (such as retailers) can become a real obstacle to D2C ecommerce growth, as new products or promotions are not introduced or are “watered down” to appease existing channels including retail and eMarketplaces. Similarly, misalignment may result from differences in marketing messages across different communication channels, managed by teams that are responsible for different channels and customer groups. Finally, if supply is short, questions arise as to which channel gets stock allocated, and which has to let customers down.

Short-term orientation impairing development of great customer experience

D2C teams often have little or no incentive to focus on consumer-centricity and journey thinking, which are generally seen as the domain of different teams. Instead, the prevailing attitude is often that D2C “is just a channel to sell” and will optimise for profits. Additionally, D2C typically does not control product or brand development, which makes it difficult to prioritise long-term customer value creation.

Another important example is found in Supply Chain, which has emerged as a differentiator for ecommerce in recent years. Online “pure plays” and large multi-category retailers are lifting the standard on operations-enabled experience elements, including delivery times (“Same Day” and “Next Day”), traceability, product hyper-personalisation and seamless returns.

Having a competitive Supply Chain and Operations function for ecommerce will require something different than serving existing retail customers (B2B2C), and comes with a price tag, collaboration across functions and management of partnerships with logistics suppliers. Typically, these cross-functional dynamics and levels of investment required weaken the ambition to create a world-class customer experience on the D2C platform and may hamper growth over time.

Unimaginative scope in the proposition

Growth in D2C ecommerce may be held back by hesitation to take advantage of the much broader set of product opportunities that ecommerce allows for, especially given the direct-customer relationships D2C can provide. This broader set of opportunities can be leveraged through own-product innovation, white labelling, or even third-party products (3P) and marketplaces.

Commitment to D2C

To succeed in D2C ecommerce, top leadership must be fully committed to its prioritisation. First, the strategic role and ambition of D2C need to be clarified. The strategic role and ambition would include clarity around target customer segments for D2C versus other channels and distinct guardrails for the value proposition that needs to be designed and delivered.

The job of the CEO, the Board, and the whole executive team should then be to shape the details and support the organisation’s D2C ecommerce strategy and ambition and translate these into practical KPIs across different functions of the organisation. Succeeding in ecommerce requires cross-functional and cross-channel collaboration at an unprecedented scale, as well as bold decision-making to achieve breakthroughs, to satisfy the extraordinarily high standards customers expect from an online business today.

We expect that the pressure on top leadership to take executive responsibility for ecommerce is likely to increase organically, given its large and growing contribution to company value. For listed companies, shareholders will increasingly demand ecommerce results, as companies with direct relationships with their customers significantly increase value, for example through subscription models.

Subscription businesses, which are typically strongly embedded in online and ecommerce, grew their revenue about six times faster than the S&P 500 from January 1, 2012 to June 30, 2020. Further evidence for shareholders of the value of a strong ecommerce business is the fact that companies that have successfully shifted investor perception towards being a “tech” or “online” success have experienced significantly higher multiples, for example in retail, where the Top 25 have been able to capture a large share of total value creation. Non-listed companies are possibly even better equipped to enable large investments to achieve success in D2C ecommerce.

A practical way to acquire the necessary CEO ownership and decision-making for ecommerce growth is to appoint a leader with relevant experience in either pure-play or omnichannel ecommerce. However it is achieved, the mindset at the highest levels must be changed before the rest of the company can follow.

Be ahead of the curve, with resources and investment (“Y+1”)

A successful ecommerce business requires the right resources and technology in place to operate at scale. Hiring the right talent and building a new technology infrastructure requires any organisation to undergo large changes, and doing so while also managing a “breakthrough” ecommerce business automatically leads to higher complexity and risk. It is imperative to invest ahead and build the required resources, including people and technology, to a greater extent than usual; strategic choices should lean towards ecommerce.

A practical way to manage this reallocation of resources would be to adopt a “Y+1” investment logic. The “Y+1” concept requires adjusting resources and investment in advance of growth, using allocation rules that calculate the share of investment, with the expected revenue that will be achieved a quarter or a year in the future as input. Although this approach would result in an over-allocation of investment in D2C ecommerce compared to other parts of the business, it would help the business to move from “running behind” to “being ahead.”

Investment decisions should be made by adopting an “external investor mindset” to growth and returns. External investors typically put a premium on growth vs. margins as they are seeking long-term returns. With the consumer shift to ecommerce expected to continue, companies should ensure they take more than their fair share of that growing channel, by investing ahead of the curve.

A question which remains is how to prioritise and allocate investments ahead of the curve. One method to evaluate digital investments is based on the cash flows they are expected to generate, making sure to factor in “do-nothing” or base-case scenarios as well as the overarching objectives of the strategy being proposed. For ecommerce, the “do-nothing” case may not mean net-zero change, but rather a steady (or accelerating) erosion of value. This type of investment logic is seen in banks, which have been heavily investing in mobile banking apps and digital channels in recent years, primarily to preserve, and gain, market share.

Another way to stay ahead of the curve is to look at these investments as strategic imperatives and accept a longer-term return—similar to how IT CAPEX investments may be treated. Whichever method is used, executive teams can find creative ways to decide on the right premium to put on ecommerce resources, investment, and strategic decisions to maximise the effect of their investment on the growth of ecommerce capabilities.

Articulate a bold Customer Experience (CX) vision and constantly strive towards it

All of the most successful ecommerce businesses have adopted scalable solutions for CX, ranging from mobile and web experience design to flexible pick-up and delivery options and to driving individualisation and hyper-personalisation leveraging predictive models. This notion of predictive models is important, as it means companies can identify the needs and likely behaviour of their customers at scale, as well as what they are expecting from the platform and service levels, and what would change their minds and prevent them from making a purchase.

CX and UX decisions should, above all else, be informed by a deep and scientific understanding of customers and their needs about experience, delivery, service, and product (a “360-degree view”). Traditionally, surveys were the main source of this sort of information; however, executives increasingly recognise that survey-based measurement systems fail to meet their companies’ CX needs. Let’s face it, what they tell you rarely emulates their actual actions, whereas captured online data is finite.

Thanks to the growth of digital channels, companies can complement survey-based insights with real-time, customer-level data that is easily accessed and analysed. In addition, the rise of predictive analytics has streamlined the process of getting from data to action.

From such data, a whole set of customer journeys needs to be assessed, shaped, and optimised to deliver value to the customers. This process should leverage technology to develop an integrated proposition for the customers that can be delivered profitably. This is where scalability becomes a major source of value again; in the same way as predictive analytics, especially deep learning and machine learning, enables scalability of insights, technology enables scalability of actions across the platform and supply chain solutions. Actions translate to CX through design, content, and marketing, but it is technology that enables each of these levers to work for millions of customers.

Finally, to ensure that the customer experience is delivered effectively, it should become a fundamental part of a company’s everyday operations, and as such must be at the core of performance dialogues, incentive systems, and day-to-day discussions.

Go beyond the transaction

The final mechanism to promote the growth of D2C ecommerce is related to the customer experience and hinges on the fact that, to be economically viable, an ecommerce channel must rely on a set of core customers, since keeping a customer costs up to five times less than acquiring a new one. On top of this, increasing customer retention rates by just 5 per cent could help increase profits by 25–95 per cent.

It is accepted that there are three ways to drive recurring long-term relationships with customers: changing the business model to subscription, designing loyalty programs offering real value in return for loyalty, and/or establishing brand communities to connect with customers on a social and emotional level.

A final option to drive customer retention in the long term is to start brand communities. While starting a community may appear desirable on paper, it is an extremely difficult concept to get right—and can be a drain on resources, as the initial customer base is small, and content as well as the online experience needs to be built by the brand.

Furthermore, it may not be an effective solution for every company type. It is important to assess beforehand whether the company’s brand(s) fit one of four established “community” types: directive, transactional, conversational, or experiential. A combination of company strengths across brand recognition, individualised personalisation – avoiding segmentation wherever possible, purchase frequency, partnership opportunities, content affinity, and ability to offer activities will determine whether communities are viable for the brand. Effectively creating and maintaining a brand community is a difficult task, and one that is liable to fail, but if it is achieved, the business model is set to survive long-term.

Conclusion

These suggested management shifts highlight ways that the challenges of adopting D2C ecommerce can be overcome, and plot a course for companies eager to reap the benefits of this fast-growing and innovative area. Making such changes comes at a cost, but the rewards can be substantial.

Ecommerce has shown that it will continue to grow, and D2C is a major area in which businesses can change their relationship with ecommerce to maximize its benefits, ensuring that they stay competitive in an increasingly connected and online world. In order not to fall behind, D2C should be put on the leadership agenda—and the most powerful way to do that is by identifying the value at stake, and the opportunity to improve across our D2C management shifts for your company.