After an unprecedented increase in retail spending online in 2020, a much needed profitable growth, ecommerce penetration across all categories continues to blossom. Online sales in retail jumped 40 percent year over year in 2021, and consumers are increasingly taking an omnichannel path to purchase: across all consumer categories spanning consumer electronics to groceries, about 75 percent of consumers are researching products and making purchases in both brick-and-mortar and online channels.

Recent McKinsey research and analysis offers a detailed look at the trajectory of ecommerce in consumer goods for the next year (see sidebar “About the research”). Not only will the growth of ecommerce endure beyond the pandemic, but its evolution will also.

The proliferation of new platforms, channels, and available data will only continue. This dynamic creates both opportunities and challenges for consumer goods companies as they determine how to best engage their customer bases.

Executives will need to understand the landscape and place their bets carefully as they explore new innovations (such as the metaverse and live selling) while being mindful of the impact on their balance sheets. At the same time, they must also build the organisational ability to pivot swiftly and effectively into potentially greener pastures.

An increasingly complex consumer landscape

Three trends are set to influence how consumer goods companies identify, evaluate, and pursue opportunities over the coming year.

New ways to reach consumers will continue to emerge

Until recently, consumer goods companies commonly played in a handful of ecommerce channels, usually led by Amazon. However, consumer goods companies must be active across many new platforms and formats to keep up with where consumers are engaging and shopping.

Omnichannel fulfillment alternatives to in-store shopping—such as home delivery (from a local store), ship to home (from a distribution center), and click and collect—continue to see accelerated demand from consumers. Social commerce, which expands reach by selling through social media channels, is expected to more than double from 2021 to 2025, when it will account for about $80 billion in retail sales. This explosive growth puts the United States second in social purchasing only to China, where that channel already makes up more than 13 percent of the ecommerce market.

With the growth of quick commerce (home delivery in less than one hour and as fast as 15 minutes), new entrants such as JOKR and Gopuff are resetting customer expectations around delivery speed. This channel is projected to remain a small portion of total ecommerce sales in grocery, but it is having outsize influence: in 2021, about 30 percent of online grocery shoppers opted for delivery in two hours or less, and 14 percent of consumers expressed an intention to increase their usage of express and same-day delivery.

Competition for marketing and trade dollars will heat up

Profitability challenges, exacerbated by the growth of ecommerce, are forcing retailers to look for new avenues to increase margin. Commerce media—for example, retail media networks (RMNs)—offers retailers the ability to monetise their first-party consumer data by selling advertising to brands on their websites.

Amazon’s own exploding ad business, predicated on the same rich transaction data that all retailers have on hand, provides a huge incentive for retailers to get in the game. Further propelling commerce media’s rise is the shift in consumer preferences and regulations around data privacy, which has enhanced the attractiveness of closed-loop channels built on fully user-consented first-party data. Over the past two years, more than a dozen retailers have debuted RMNs, with strong intent from others to follow suit in the near future.

Our survey of 100 consumer goods ecommerce decision makers found that approximately 15 percent of total advertising and promotion spending is already being directed to commerce media, which typically represents anywhere from 2 to 10 percent of gross sales (depending on the subcategory). Spending in the channel is projected to reach more than $100 billion by 2024 (including Amazon), growing twofold to threefold each year.

Commerce media will be a challenge for consumer goods companies at first because it puts additional pressure on their marketing dollars and profit-and-loss (P&L) ratio. Yet if managed appropriately, it will allow consumer goods companies to improve not only marketing efficiency but also the shopper experience.

Approaches such as RMNs can provide a tailored, personalised experience that fits evolving consumer preferences related to privacy, control, and transparency. Consumer goods companies can also use commerce media to enrich their data foundations for targeting and closed-loop attribution. If they execute these approaches effectively, consumer goods companies can boost return on ad spending in this new channel by three to five times.

Personalisation and precision targeting will become the absolute top priorities

The rise in online transactions and the general digitalisation of commerce are creating an unprecedented volume of data about how consumers shop and engage with brands. With transactions shifting online, companies also have greater visibility into the purchasing journey, including metrics such as cart abandonment, add-to-cart rates, browsing behaviour, and time to purchase.

Retailers are particularly well positioned to capture these data (given their direct relationship with shoppers) and have been putting them to use to create more personalised experiences. In turn, their consumers have quickly grown to expect companies to deliver personalised, relevant interactions. While consumer goods companies might not collect data at the same rate as retailers, they have had to become more sophisticated in their data management capabilities to meet the ever-rising bar of customer personalisation and to achieve returns on their investment.

Five winning practices to help companies stay ahead of the curve

To lead in the ever-shifting ecommerce landscape, winning consumer goods companies are investing in five key areas to set themselves apart (see sidebar “How we define winners”). They are also working to ensure their organisations are set up to fully support these initiatives—from resources, talent, and capabilities to processes and culture.

1. Profitable growth requires your communications adopt predictive personalisation

The focus in recent years in ecommerce has been on CRO (Conversion rate optimisation), consequently many retailers have been blind to the obvious fact that CRO requires the consumer to visit you, or more importantly, your site. This requires effort to encourage them to do so, immediately a second tier of marketing needed, with inherent additional cost. Predictive personalisation software (PPS) however, however gets in ahead of that game and takes that personalisation to your consumers, with the advantage of the ability to make sales, before thriving platforms like Amazon and Alibaba, get a look in.

Selecting imminent product selections on a personal basis, based on not only buying history, impressions and navigation, by AI analysis with machine leaning, accurately knows what each individual is most likely to purchase next, puts it in front of each one at exactly the right time. No subsequent marketing layers required, indeed it totally autonomy negates need for pre-existing layers traditionally anticipated – no staff, no overheads. in addition autonomy means operational 24/7, no errors, no omissions or other human frailties usually associated with operational performance. No wonder it is delivering returns beyond imagination, the era of robotic email marketing has begun.

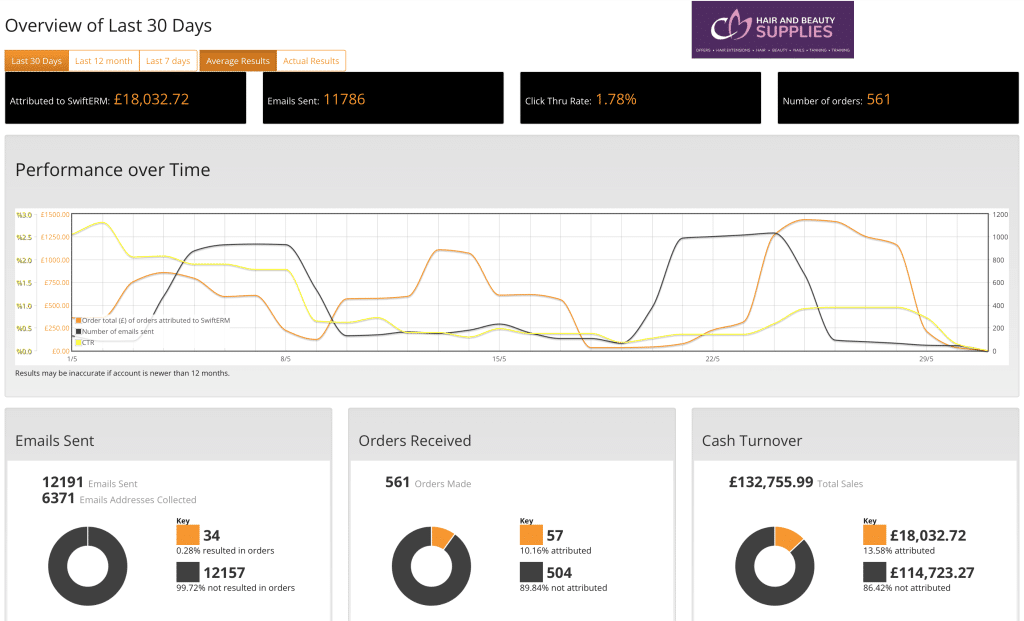

Example: Predictive personalisation delivering in excess of a 10,000% ROI.

2. Be wherever consumers shop—in a targeted and strategic way

Winners are active across the full spectrum of ecommerce channels, strategically and intentionally, with the aim of engaging consumers in their preferred way. Two-thirds of winning consumer goods companies plan to sell through food-delivery platforms (such as DashMart by DoorDash and Cornershop by Uber within the next 12 months, compared with just 25 percent of their peers.

Approximately 20 percent of winners intend to sell through social platforms such as TikTok and WhatsApp, even though the purchasing capabilities of these platforms are just coming into existence. Consumer goods companies need to be where their shoppers are; as new platforms emerge, players that can embrace them rapidly will be best positioned.

Playing across platforms is most effective when done intentionally. As winners engage with more ecommerce partners, they set clear strategic objectives and key performance indicators for each: our research shows 80 percent of winners assign distinct, clear roles by channel by nuancing messaging, content, assortment, and pricing accordingly.

And as each new channel emerges, leading consumer goods companies rapidly develop perspectives on the channel’s relevance to their consumers and determine plans of action for product placement. Staying on top of consumer trends that affect channel preferences will be critical to increasing online sales and finding new ways to reach households.

Selling through these platforms may compel B2B2C companies to develop new capabilities. Adjusting processes, organisational design, and resources to account for this capability gap will shorten response times and increase speed to market.

3. Invest in data and analytics to enable flexible, full-funnel marketing

As marketers lose access to third-party data, winners are seeking to close gaps in their consumer information by building owned, content-first online platforms and loyalty programs designed to enhance consumer engagement through rewards or services. For example, a leading packaged-food company with a large loyalty program recently revamped its strategy for digital formats by building a proprietary mobile application specifically for its rewards program. This new shopper-engagement platform achieved the dual goal of strengthening shopper loyalty and collecting valuable, user-consented first-party data.

Capturing data is just the first piece of the puzzle. Winners invest in the right tools, partnerships, and capabilities to build an internal 360-degree view of consumers to meet shoppers’ increased demand for personalisation. Companies can aggregate transaction data, media exposure and interaction data, website activity, first-party data, and additional data sets to link a consumer ID across multiple different data systems.

With this information, organisations can take chronological views of consumers’ engagement to build a fully automated, repeatable, scalable methodology to identify future activation opportunities in a personalised way. This approach can capture meaningful business value: for example, a food company recently improved its return on digital advertising spending more than 40 percent by targeting look-alike audiences using first-party data.

4. Maintain a laser focus on continuous improvement

Winning consumer goods companies are embracing agile operating models that accelerate the pursuit of opportunities, improve execution outcomes, and unlock value. This approach includes standing up cross-functional teams, or “pods,” to create daily, purpose-driven collaboration among marketing, sales, creative, technology, data and analytics, and more on an ongoing basis.

In the coming years, consumer goods companies can differentiate themselves by their ability to operate these pods and build true test-and-learn muscles. Agile pods will require dedicated data scientists and engineers to execute a standard measurement playbook and continuous improvements. Gone are the days of gut-feeling-driven decision making across merchandising, pricing, promotions, assortment, and content online. Execution decisions will be made based on granular insights to drive outsize growth.

The adoption of these new ways of working and the focus on continuous, data-driven improvement are evidenced in the survey data: winners are 21 percent more likely to emphasize test-and-learn approaches to improve online performance compared with other consumer goods companies.

For example, a leading beauty manufacturer launched an agile pod focused initially on Amazon. By quickly testing and identifying the most effective tactics across core performance levers, the company gained insights on specific actions, adjusted based on specific learnings, and rapidly scaled to reach a specific, quantified goal.

The result: a doubling of sales on Amazon and a fourfold acceleration of the creative development process. The company is now exploring establishing a broader, formalised test-and-learn program across other channels and retail partners.

5. Invest in digital talent ahead of the curve

Foundational digital literacy and analytics capabilities are critical enablers in achieving a long-term competitive advantage in ecommerce. Doing so requires in-house proficiency of technical talent, tools, and capabilities. While leaning on third-party agencies or partners may boost sales in the short term, an over reliance on external providers over the long term may hinder a company’s ability to increase ecommerce sales in the fastest, most efficient manner.

Winning consumer goods companies recognize that digital fluency must be embedded at all levels of the organization, from the front line to the C-suite. A leading household goods company launched a formal mentorship program between senior executives and junior marketing analytics employees with the dual goal of increasing fluency among senior leaders in direct-to-consumer functions and providing mentorship to more junior colleagues.

Executives learned firsthand the power of differentiating proprietary data, including attribution modeling, performance marketing, personalisation, and more. This knowledge helped senior executives understand which capabilities could be outsourced versus built in-house. Perhaps most important, the initiative created demand for digital solutions across the organization and built momentum for continued digital capability building.

6. Rethink the end-to-end supply chain to support omnichannel growth

Winners are investing in foundational areas such as supply chain and operations: they are 40 percent more likely to recognise their supply chain as a key challenge in achieving their ecommerce vision and up to three times more likely to make it an organisational focus.

Winning consumer goods companies are focused on two key areas when it comes to operations and their supply chain. First, they integrate more closely with retail partners to improve demand forecasting, inventory management, packaging design, and fulfillment. For example, winners are roughly four times more likely than others to participate in Amazon’s Vendor Flex program, in which purchases are shipped directly from the consumer goods company’s warehouse to consumers.

Second, winners are taking an omnichannel approach to manufacturing and packaging design, considering what is best for both the brick-and-mortar business and ecommerce fulfilment (from home delivery to shipping).

For example, a leading household goods company adopted “ship in own container” packaging, which improves sustainability, reduces wrap rage—the anger and frustration resulting from a consumer’s inability to open product packaging—and is often significantly cheaper to store and ship than traditional retail packaging. Other consumer goods companies have experimented with pack sizes and product formulation to reduce shipping weight.

Conclusion

Winning at ecommerce is not about optimising the current business to play in a digital world. It instead reimagines business through an omnichannel-first lens. In everything from commercial decisions and processes to talent and human capital management and data, on-the-margin tweaks to the existing operating margin do not create winners.

While the channels and platforms “of the moment” might be clear today, the digital world is a moving, ever-evolving target. Winning in this space will require more than executing successfully in opportunities today; organizations must leapfrog the competition by being nimble and digital-first. Companies that fail to make digital an organization-wide priority across every function put their relevance, profitability, and market share at risk in the near term.