Ecommerce revenue growth management. Consumer-packaged goods (CPG) leaders have faced difficult and constrained times over the past decade. Growth in the consumer industry has been challenging, to say the least, over the past few years. Margins have been sustained primarily through productivity gains to offset the effect of price compression. In this context, CPGs have needed to build new capabilities to capture more value from RGM.

While 2020 brought volume growth for ecommerce-led CPG verticals, the overarching issues have been exacerbated by the inability to sufficiently leverage RGM. Now, as CPGs look ahead, they are facing three major challenges: to relieve P&L pressure from commodity inflation at a level not seen in over a decade, to address consumer and shopper shifts, and ultimately to develop repeatable ways to align prices with or beyond the consumer price index (CPI).

While the pandemic provided a pause—RGM was understandably not a priority for companies in the past year—it also unleashed a wave of new challenges.

First, there is the return of inflation. Many commodity prices are spiking and are expected to remain high (exhibit), driven by everything from global supply-chain disruptions when the pandemic hit to the more recent strong rebound in consumer demand with limited capacity to meet it.

These factors are significantly raising input costs for CPG companies, resulting in greater than double-digit increases in the cost of goods sold (COGS) in some situations. Given the extent of inflation, multiple retailers have publicly expressed an expectation for higher CPG prices.

Secondly, there have been unprecedented changes in consumer behaviour, shopping habits, and channel dynamics in the past 18 months, which are likely to influence all categories for years to come:

Consumer behaviour: declining brand loyalty, increasing at-home needs, and a K-shaped recovery. Across markets, 25 – 40% of consumers have tried different brands, highlighting the importance of promotion to attract brand switchers. All be it strategies for ecommerce loyalty abound.

Second, demand has spiked for categories like health and wellness and “at-home” needs, a trend that is expected to persist in the next normal. Third, while our analysis indicates a recovery in consumption, it also anticipates sharp differences geographically and across income segments. Consumption from high-income households will likely determine the economic recovery’s magnitude and pace.

However, the resulting higher savings rate has been more elevated among high-income households, and the outlook for low-income household consumption can be negatively impacted by the labour market. In Asia, the largest drivers of growth are expected to remain the increasing incomes and spending of low-to-mid-income households.

Shopping habits: bigger baskets, fewer trips, and changing preferences. We see shoppers doing more stock-up and fill-in buying than impulse purchasing, although there are important nuances. Additionally, research shows the shopper base has divided even further. For example, 19 % of Europeans have already traded down and plan to continue doing so further.

Channel dynamics: a dramatic shift toward online retail and “at-home” channels. Online retail has grown by more than 50 % in some categories, accelerating a long-term trend, with a high share of consumers expected to continue shopping online. Second, “out-of-home” channels, historically often more profitable for CPGs, have materially shrunk, presenting additional complications. B2B marketplaces have grown to serve fragmented small grocers, impacting traditional distributors.

In Europe, pressures on retailers have made net price reductions the norm rather than the exception. CPGs now find themselves needing to catch up to compensate for both the past 18 months and for longer-term behaviour.

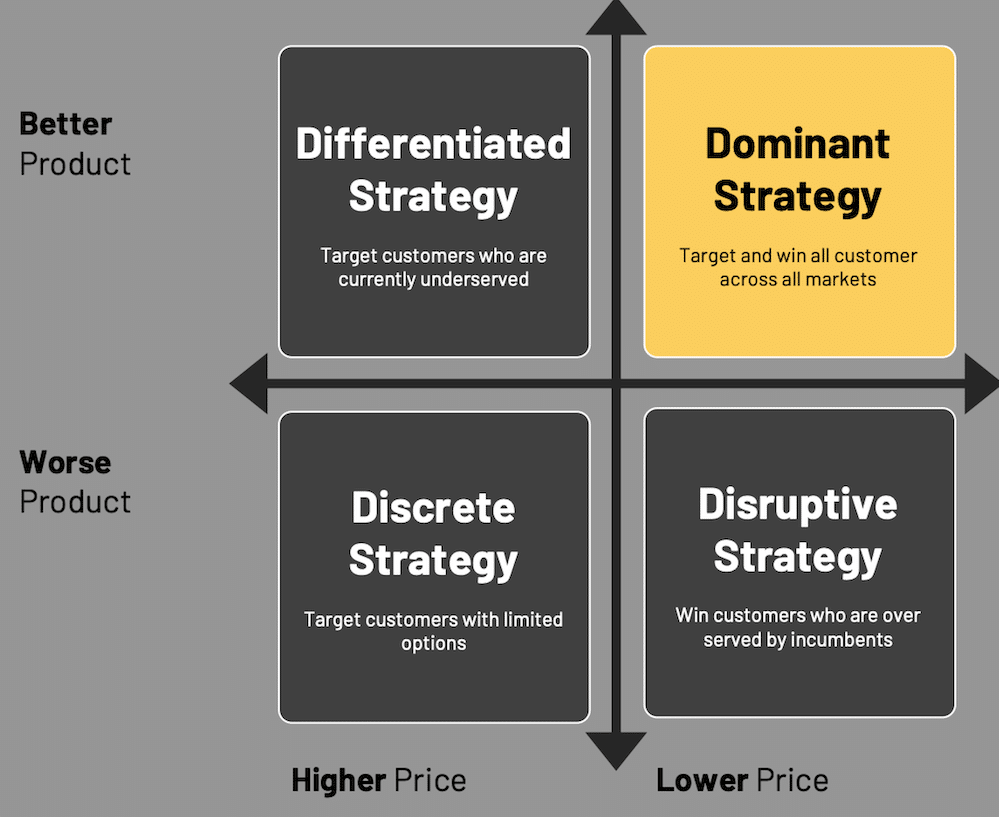

Driving growth through a differentiated approach

While the outlook remains unclear, we see CPGs shifting from simply meeting demand—the stance for many has been pursuing margin and growth in this new context. Indeed, companies from food to household and personal care have announced price increases in the mid to high-single-digit range.

While inflationary pressures often cause CPGs to use pricing to support margins (and this is also happening), companies that have successfully navigated such circumstances in the past consider near-term pricing actions strategically, defining a multiyear journey to realise their pricing objectives through a mix of RGM levers, rather than simply using headline pricing across the board.

Indeed, shifting dynamics and the inflationary environment call for an even more comprehensive assessment of the levers available to companies to meet their pricing objectives. CPG leaders need to rethink RGM’s main elements— pricing, trade and promotion investment, assortment —and how to combine them to create the necessary “muscle.”

- Pricing. While it is tempting to move fast to cover input-cost inflation, CPGs need to set a pricing strategy for the long term. It’s critical to take a nuanced approach, informed by volume, simulations of the impact of price moves on profits, and measurement of net elasticities, for example. Given the macro-economic dynamics at play, it will also be important to assess the impact of pricing decisions, across price tiers and income segments, on the affordability concerns of consumers.

Taken together, these actions facilitate surgical rather than flat price increases across the portfolio or even in micro-geographies, balancing revenue and profits against volume, penetration, and market share. Finally, it will be important for CPGs to understand the full implications of the evolution to online buying and increased transparency and to adjust their pricing actions appropriately. - Trade and promotion investments. While there may likely be competitive pressure and a tendency to simply revert to 2019 levels over the coming months, promotion reductions enable re-baselining and “retraining” shoppers.

Resetting in the right way requires a clear view of the impact of new consumer behaviour during promotions and of the short to long-term impact of promotions. In Europe, the focus on net price management means some reductions will likely need to be shifted to other conditional trade terms to compensate.

We could see a significant shift to pay-for-performance structures and more conditional trade terms. In growing emerging markets, there’s demand for new trade-investment approaches, such as leveraging digital B2B marketplaces.

In Asia, a shift in 2020 to modern trade in some markets, at the expense of fragmented trade, requires CPGs, who have historically focused more on route-to-market excellence, to shift toward structured trade investment and promotions. Finally, CPGs need to ensure they are effective in the growing online channels, including the introduction of AI machine learning-based hyper-personalised campaigns. - Assortment. Equally important is resetting the assortment based on true incrementality and cost of complexity. CPGs seek to address the challenges of changing their product mix to offset margin pressure, retail demands for portfolio simplification, and new shopper behaviours. While not returning to the 2019 level of SKU proliferation, CPG companies need to mindfully introduce “good complexity” by selecting innovations and SKUs that are truly incremental.

Additionally, as a result of shifting consumer habits, micro pockets of consumer growth (such as shopper type, income level, and location preferences) have shifted. Identifying these micro pockets and acting on them through a superior understanding of markets and consumers has thus become even more important, and the key to winning them could be getting the above RGM actions right.

Implementing these measures requires solid RGM analytics. The fluid nature of transforming consumer spending habits and the supply shortages in 2020 have created noise in the historical data and are making it more challenging to identify relevant data trends.

This calls for RGM teams to adapt their data-and-analytics approach to incorporate different consumer insight sources. These include sentiment surveys to get updates on behaviour shifts in time to react, data-set partitioning to isolate temporary effects and train analytical models accordingly, and an increased frequency of data-set updates to be able to monitor changes.