Cost per Acquisition (CPA) is one of the most important metrics that marketers should track and measure. Why? Your CPA will give you an estimate of how much your new customers are costing you and help you determine whether your strategy needs to be revised.

Unlike the conversion rate, which is an indicator of success, Cost per Acquisition is a financial metric used to measure the revenue impact of a marketing campaign.

What is the Cost per Acquisition

Cost per Acquisition, also known as Cost per Action or CPA, is a marketing metric that measures the cumulative costs of a customer taking an action that leads to a conversion. Sometimes, a conversion is synonymous with a sale, but it can also be a click, a download, or an install.

Ad networks will give you the option of choosing between CPA, CPC (Cost per Click), and CPM (Cost per 1000 impressions) bidding. The reason CPA bidding is preferred by marketers is that you are paying for a direct result, and you can compare performance across channels (when you are running campaigns on both Facebook and Google for example).

How to Calculate Cost per Acquisition

The mathematical formula for calculating the CPA is:

CPA = the total cost of a campaign/number of conversions

Let’s take a practical example. Let’s say you run a Facebook campaign for your online shop that sells flower bouquets and your total budget for that campaign was £500. After the campaign ended, you calculated that it had brought you 25 sales. So what is the CPA for this campaign? £500 cost of campaign / 20 conversions = £25 CPA. If you responded to £25, then you are correct!

But how do you know whether that’s a good or bad CPA?

CPA and CLV are closely connected. CLV (Customer Lifetime Value) represents the total amount of money that a particular customer is likely to spend over his or her lifetime relationship on your website.

The reason you want to know the CLV for each customer is that you want to make sure you’re not paying more to get a customer than what they are worth to your business, but also to determine which channels are the most effective for your business. Therefore, you’ll want to make sure that CLV> CPA for each channel.

How to calculate your target Cost per Acquisition

Your target Cost per Acquisition is determined by the budget you can allocate to acquire a new client. To determine that budget, first, you need to calculate Customer Lifetime Value (CLV). The CLV is the dollar amount the average customer brings into your business over the lifespan of the relationship.

Step 1: Calculate the CLV

Depending on your business goals, there are several ways you can determine the CLV.

Case A:

Let’s get back to our previous example. You are the owner of an online shop that sells flower bouquets. If you only have one type of bouquet available and it costs £10, the CLV is £10. If your customers only pay once, then the average amount they pay is your CLV.

Case B:

If you are sending flower bouquets to your customers regularly (meaning you have a subscription business model), you also need to include the churn rate (the percentage of customers who stop subscribing to your service each month) and the monthly amount of revenue you expect from each customer in your CLV calculation. In this case, the formula for calculating the CLV is the average monthly revenue per customer/churn rate.

If your monthly subscription is £100, the average monthly revenue per customer will also be £100. And if every month 25% of your customers cancel their subscription, your churn rate is 25%. Which means that your CLV is 100/.25 = £400.

Step 2: Determine the budget you can afford to spend on marketing

Once you have determined the average CLV, it’s time to find out how much of it you can re-allocate to marketing. And for that, you need to know how much your operating costs are. Your CPA target is determined by your non-marketing fixed costs: if your fixed costs are high, you need a lower CPA to remain profitable, but if your fixed costs are low, you can afford a higher CPA.

If your monthly operating cost is £1000 and your CLV is £400, 40% of the CLV will go to your operating cost. This means that the maximum amount you can afford to spend (and remain profitable) is £159 (£400 * 0.4 = £160).

How to reduce Cost per Acquisition

Most marketers focus on sales and traffic acquisition and don’t think about cost optimization. But it’s best to think about reducing CPA from the very beginning because that way you will not have to think about ways to increase conversions later. Reducing the Cost per Acquisition can increase your Return on Investment (ROI) within a relatively short period.

Below we have put together a list of best practices that will help you reduce the Cost per Acquisition.

1. Landing page optimisation

Your landing pages have a significant impact on conversions because they are the first thing your customers see after clicking on your ad. To measure the effectiveness of a landing page, run an A/B test where you change a single characteristic of that page.

For example, you could drive half of your traffic to a generic landing page and the other half to a page with a targeted offer, and determine which of them brings you the best results. By doing this, you will know what kind of landing page brings you the most conversions and helps you reduce CPA long-term.

Find the winning version of your website using A/B testing.

2. Identifying purchase intention

By using surveys, you can identify the purchase intention for various sources of traffic and adjust your marketing budget accordingly. Two different traffic sources can have a similar conversion rate, but bring you customers with different purchase intentions and retention rates. That depends on how loyal they are and how effective the channel/initial nudge was.

Want to find out why some customers convert on your website, while others don’t? Start using surveys now!

3. Check-out process optimisation

The average check-out shopping cart abandonment rate is 68%, and the top reason people abandon their carts at check-out is hidden charges. So be straightforward about the total amount of the purchase, including shipping fees.

Other reasons customers abandon their carts at check-out are related to technical issues (website time-out, website crashes, screen freezing, etc.). By creating a more pleasant experience for your customers, you will also lower your Cost per Acquisition.

4. Retargeting

Retargeting/remarketing helps you reach out to people who have bounced from your website. By connecting with potential leads, you can, hopefully, convert them into customers. This means that increasing your conversion rate by using retargeting techniques can reduce your Cost per Acquisition.

For e-commerce businesses, a special segment of bounced traffic is represented by users who have abandoned their shopping carts. These users have a strong inclination to buy something from you, more so than website visitors for example. With the right offer, converting them into customers after retargeting should be easy.

5. Predictive Personalisation Software

Hyper-personalisation software has moved forward enormously in the last few years. You are now able to present exactly the product that each consumer is most likely to buy next in front of them at exactly the right time. This wholly autonomous facility skyrockets customer lifetime value as average basket sizes soar. Significantly a huge ROI is delivered, further complemented by your rate of return falling through the floor.

Personalized ads are important, so make sure you understand why personalisation dominates marketing ROI! There is no greater return in marketing than predictive personalisation. It identifies every consumer’s taste, which is perpetually changing, and matches that with the most closely aligned SKU from your stock. capturing phenomenal additional revenues.

6. Applying the Pareto principle to targeted locations

The Pareto Principle is the observation (not law) that most things in life are not distributed evenly 80% of your sales come from 20% of the locations you are targeting. So by focusing your budget on these locations, you can generate more sales, which in turn will lower your CPA.

Once the sales start pouring in and you get a bigger budget to spend, you can go back and focus on those low-sales locations.

7. Using exit-intent overlays

By using exit-intent overlays you can re-engage your visitors and find out why they’re not converting. One smart way to do this is by using the logic branching exit-intent overlays with objection treatment: if your customers are not convinced by the price/return policy, you have various scenarios at your disposal to address those objections.

8. Improving Google Quality Score

Quality Score is Google’s rating of the quality and relevance of both your keywords and PPC ads. It is used to determine your cost per click (CPC) and multiplied by your maximum bid to determine your ad rank in the ad auction process.

To improve your Quality Score, you need to find the most relevant keyword groups for your business and enhance your UX. This will also improve the clickability of your ad. An improved Quality Score will translate into a lower Cost per Click and Cost per Acquisition.

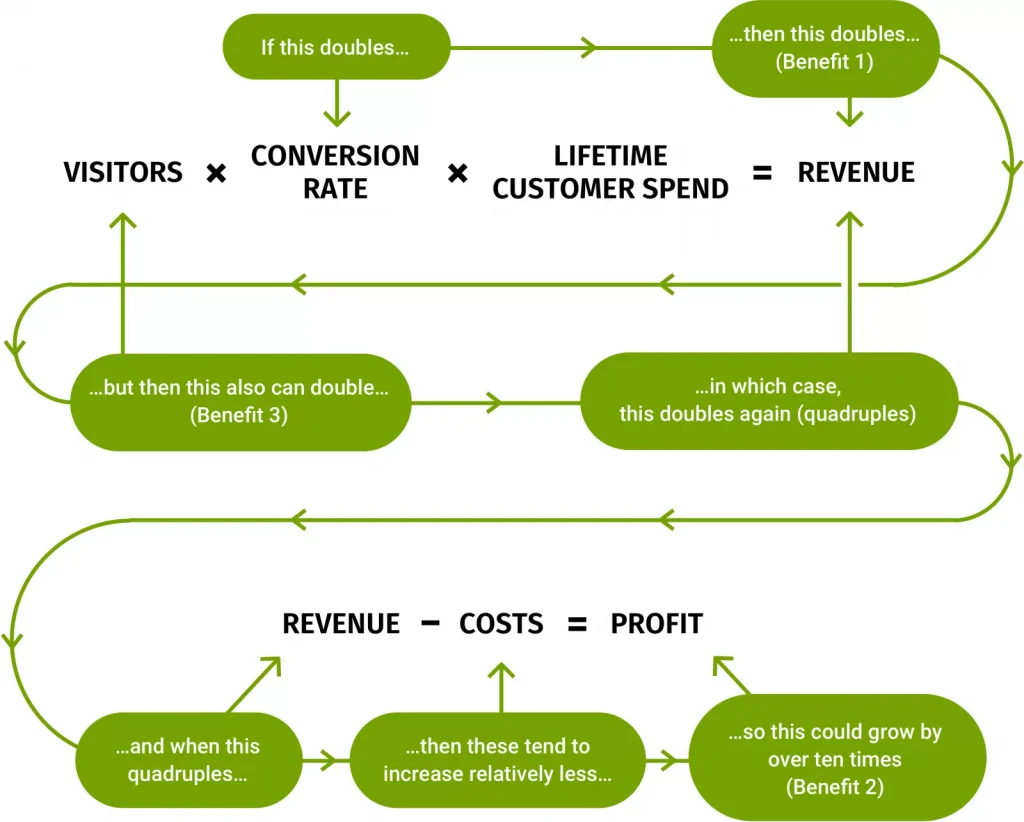

These methods will significantly reduce your Cost per Acquisition, which means you’ll have a bigger budget to reach your target KPIs. Below, you can see a model that demonstrates why you should focus on conversion rate optimisation: