The shift toward ecommerce in the last few years on consumer packaged goods (CPG) companies’ profitability, had the following themes emerge – some surprising, some less so.

Ecommerce margins are slim, at least initially—but scale helps.

Some CPG categories are much more profitable online than others. Judging from the results of a McKinsey survey of 50 CPG executives who are decision-makers in their companies’ ecommerce businesses, a category’s ecommerce penetration rate appears to be positively correlated with higher online margins.

Each retailer’s focus and strategy for a given category also have an impact on margins: some mass retailers, for instance, are willing to be loss leaders on key value items. Among online channels, Amazon tends to deliver the lowest margins, but, even there, performance appears to improve with online scale.

Digital advertising and logistics drive e-commerce costs.

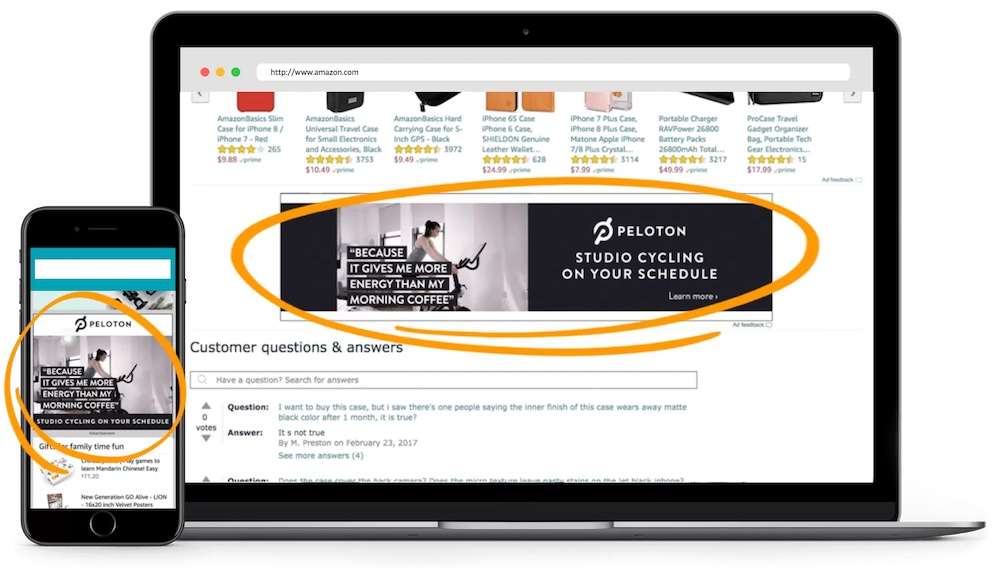

Promotional allowances tend to be higher offline than online. But other costs – most significantly on-site advertising and logistics, are typically higher in online channels than in brick-and-mortar stores. On-site advertising, or the ads that appear on retailers’ ecommerce platforms, tends to be costly for CPG companies because they invest heavily to ensure the prominent placement of their products on the “digital shelf.”

Shipping and warehousing costs are higher online for several reasons, including the following: choppy ordering patterns (because orders, particularly from Amazon, are algorithmically generated and non-collaborative), which make forecasting more difficult.

This has led to mixed-pallet (versus full-pallet) configurations and less than truckload deliveries; higher penalties from online retailers (such as the fines that Amazon charges for poor compliance with its “Ships in Own Container” and “Frustration-Free Packaging” guidelines). This is especially true in the food category, the need to reconfigure or repackage certain products to make them suitable for ecommerce. Overall, channel profitability is therefore still highest in brick-and-mortar stores.

CPG executives expect margins to improve.

The executives we surveyed expect a modest acceleration in margin growth, from an average of 0.2 percentage points in the past two years to 0.4 percentage points in the next two years—primarily because they expect to both sell higher volumes online and get significantly better at ecommerce.

For example, by building their price-management capabilities or by improving supply-chain operations so that they avoid incurring retailer penalties. Across online channel types, the highest expected profitability increase is in omnichannel retailers’ websites (such as Walmart.com or Target.com). Executives are also fairly optimistic about increasing their margins on Amazon—a reversal of the historical trend.

Companies must then deploy margin-improvement strategies targeted at the biggest cost drivers: marketing investment, ecommerce revenue-growth management (eRGM), and the omnichannel supply chain.

Ecommerce marketing investment

The distinctions between shopper marketing, digital marketing (ads and other promotional material appearing on digital channels), and e-commerce marketing (ads aimed specifically at boosting online sales) aren’t always clear, especially when it comes to budget setting and performance management.

Historically, CPG companies have drawn largely from their shopper-marketing budgets to fund direct advertising on retail media networks (RMNs) such as Amazon Advertising, Walmart Connect, or Roundel (Target’s media company). Yet ad spending on RMNs could justifiably be categorised as e-commerce marketing, given that the spending can be directly linked to higher traffic and conversion on the relevant retailer platform.

Research and experience suggest that CPG companies spend an average of 7 – 9 % of gross sales on RMNs—a percentage that appears to be sufficient for maintaining online shares. Brands looking to gain share or accelerate growth tend to spend three to five percentage points more on RMNs than the category average annually. When launching a new brand or SKU, companies spend double or triple the average for a sustained period—typically six to 12 months.

What CPG ecommerce winners are doing

Measuring returns on a company’s marketing investment gets even more complicated when taking trade and promotions into account. After all, as more eyeballs move out of the store aisle and onto digital channels, an endcap or special in-store display becomes less valuable. As omnichannel shopping continues to grow, CPG companies are starting to think holistically about their e-commerce investments:

- Funding. Leading CPG companies are reallocating dollars from brand budgets and pay-to-play trade to pay-for-performance RMNs. Doing so isn’t easy, since traditionally these budgets have been managed on different planning timelines and by different parts of the organization.

CPG companies will need to reimagine their planning processes—for example, by having cross-functional budgeting and joint performance-management sessions—to generate a clear view of total investment; they’ll also need to develop a more agile reallocation mechanism to shift spending quickly as opportunities arise. In addition, leading companies are more closely examining accounting placement: which marketing funds should be allocated to a specific customer versus which should be considered “top of the funnel.” - Attribution. Companies must clarify cost-attribution models to ensure apples-to-apples comparisons across channels. Few companies have cracked the code on measuring the omnichannel ROI of their ad spending, but recent advancements in advertising and media platforms, as well as rapidly evolving data and advanced-analytics capabilities (such as ROI modelling), are allowing for improved cross-channel attribution, legitimizing the value of e-commerce investment and facilitating better-informed investment trade-offs.

- Performance management and stakeholder coordination. Creating a “single source of truth” on omnichannel performance is a priority task for many CPG companies and an important step toward better investment management.

Companies looking to improve their margins are also tightening coordination among internal teams, agency partners, and retail partners to enable dynamic investment shifts across marketing tactics and channels. For example, an “always-on” strategy for priority retailers might be sensible but would be inefficient without well-defined budget caps (such as limiting paid-search spending on RMNs to between only the hours of 9:00 a.m. and 5:00 p.m. local time). Executing such changes requires close coordination among multiple stakeholders. - Hyper-personalisation is a key way that brands create relevancy for consumers. Leveraging demographic, behavioural, and other data, helps brands demonstrate they know and understand each subscriber on a meaningful level.

AI hyper-personalisation for customer communication technologies identifies each consumer’s future behaviour by ranking every product you sell, by the greatest likelihood of that specific individual consumer to purchase. It presents it them at exactly the right time, thereby maximising that individual’s customer lifetime value CLV potential.

More details on this are available on this post https://swifterm.com/ai-personalisation-guide-a-technical-solution/)

Ecommerce doesn’t have to be a money loser for CPG manufacturers. However achieving online profitability will require significant mindset changes among CPG leaders: instead of focusing exclusively on top-line growth, they must integrate margin-focused thinking into their strategic and operational planning. And they must embrace a test-and-learn approach, rapidly abandoning failed initiatives and scaling up successes.

In light of the dramatic acceleration in e-commerce across categories, there’s no time to lose; CPG companies that don’t act quickly will soon find themselves unable to catch up.