Andrew Isenman explores stock levels before, during and after the cataclysmic last 2 years, using a technique called time series forecasting.The data that is used in this article spans from July 2018 through to April 2021 with forecasts being presented into 2022. The data has been collected daily from four UK based online retailers and is presented anonymously for the purposes of wider industry analysis.

Whilst this data is only sourced from online retailers, the results are consistent enough to assume that the same patterns would be seen in the physical retail setting. Predictions should, by their nature only be used as part of a wider decision-making process when making decisions for 2021 and beyond.

2020 was an unprecedented year within cycling retail. From the consumer’s point of view, shortages came at a time in the UK when cycling retail remained open. The habits of a population changed, at least temporarily. With more people at home, and transportation habits being adjusted, stock became a premium. In the following charts we explore to what extent the impact was felt and whether any recovery has been made.

Examples of 3 distinct cycles, parts and accessories retailers.

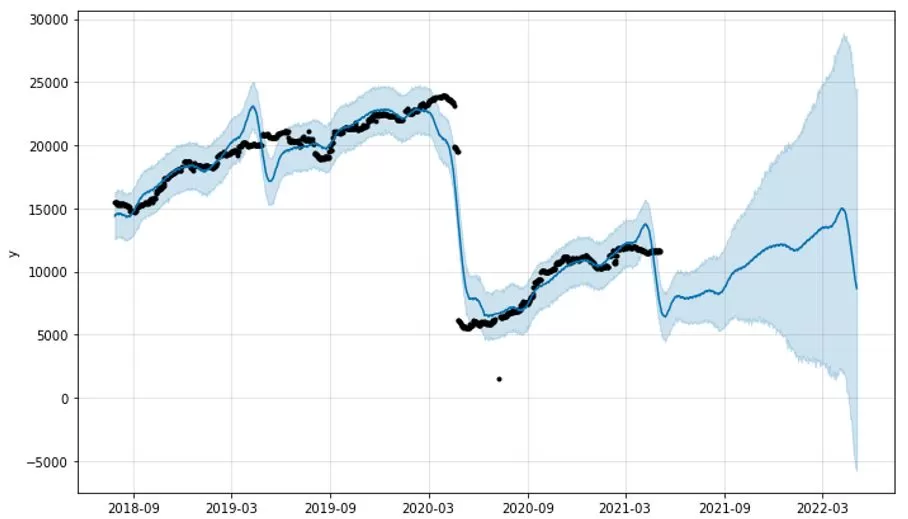

Retailer A tells a story of increased levels of stock being carried from July 2018 through to March 2020 as the pandemic hit. The increase in the 18 months previous shows an increase in over 9,000 more products being available for fulfilment in February 2020. As the pandemic hit the UK in March 2020 stock levels fell significantly with a low of just above 5,000 products available for sale. This aligns with the Government’s initial announcement that cycling is permitted exercise, thus beginning a sales boom.

Starting in May 2020 and following on to March 2021 products available for sale steadily rose as businesses began to understand the momentum, peaking at approximately 12,000 products, with a levelling off around March time. That could be the first indication of online retail giants beginning to sell through at a faster rate than they can replenish, as is reflected across the trade at large.

The model predicts stock to fall again in March and April, probably due to the demand generated by the onset of spring in the UK, and once this has passed, the model predicts that the retailers available product lines will rise again. By March 2022 available products for sale would have been likely return to levels akin to July 2018, but of course stock can only rise as fast as it lands at the docks and at the time of writing that remains off the pace by some margin.

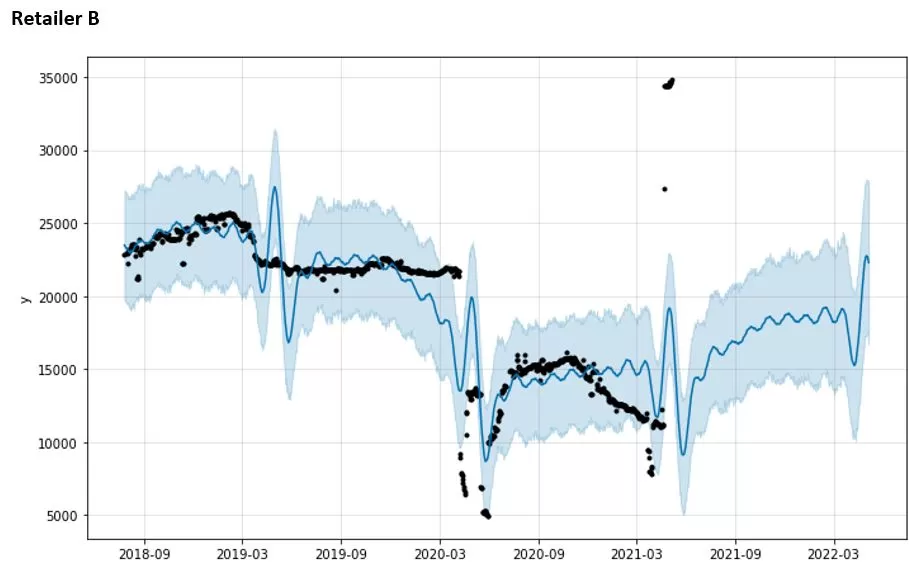

Retailer B tells a different story. Products available for sale rose slightly in 2018 and the retailer experienced the same Spring 2020 shortages as Retailer A. Spring 2019 through to Spring 2020 shows stable stock levels with neither growth or decline being witnessed. Retailer B suffers the same fate as retailer A as the pandemic hits the UK in March 2020, but interestingly this retailer is able to recover the products available for sale. This could be through a change in products carried, or by better performance by the retailer’s chosen distributors.

To some extent, a mini period of stability is maintained by the retailer from July 2020 through to the end of the year. At the beginning of 2021 the retailer experiences another dip in product availability, which seems to align with reports of shortages emerging. Based on prior buying habits, the model predicts the retailer will continue to experience stock shortages in Spring 2021 and that product levels will return to just below 2019 levels by March 2022. Again, there is a caveat of global shipping and production levels normalising.

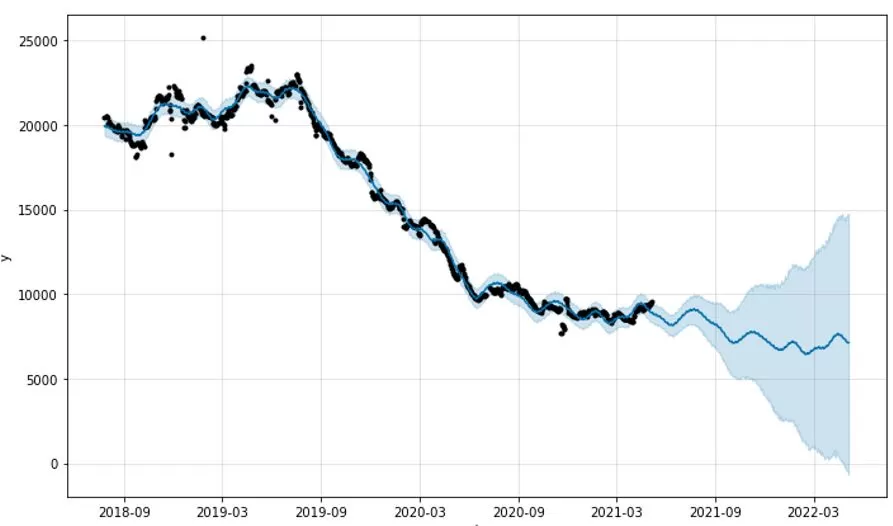

Retailer C offers a completely different view from the two before them in this article. The retailer shows product line availability growing in 2018 through to August 2019 and then a steady decline in products available for sale from Autumn 2019 through to March 2020 when the pandemic hit the UK. Interestingly Retailer C is not hit by an immediate shortage in stock in March 2020 as is seen in other cases.

We can only guess as to why this is the case without being privy to the retailer’s strategy, but one theory could be that the retailer had previously made a conscious decision to supply less products to the market but hold greater levels of stock of those products and as a by-product was able to weather the shortages presented by distributors better than the previous retailers. The forecast for this retailer is that product lines will continue to fall in the next year.

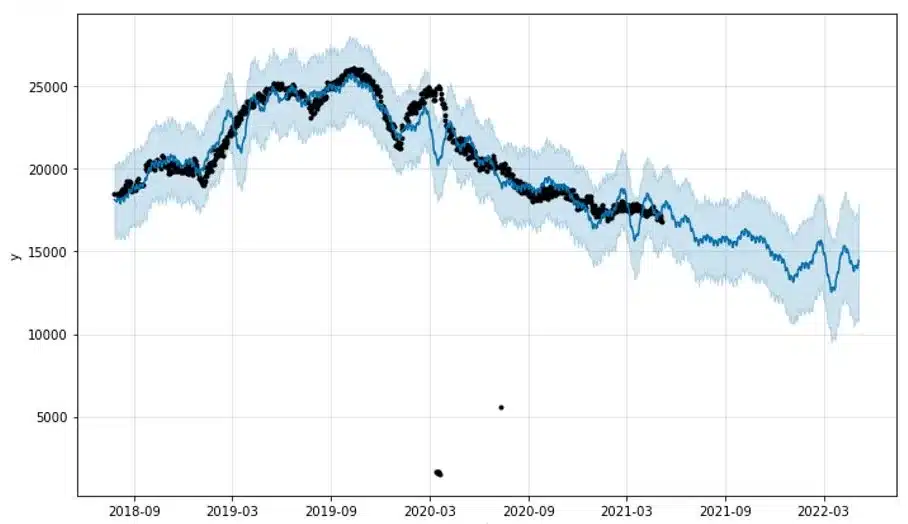

Retailer D shows a similar pattern to that of Retailer C. Growth from July 2018 through to December 2019 is evident, as are variations in products available in Spring 2019, 2020 and 2021. Retailer D also seams to weather the storm better that those above. Products available for sale have reduced since the pandemic but in a consistent fashion indicating that this could be more of a strategic decision to run fewer product lines. Another explanation could be product availability rising in the few months before the pandemic hit the UK and that the retailer had predicted the demand and in turn flattened the curve.

Summary

Data from these retailers consistently indicates that stock levels decrease in spring each year as demand picks up and that those stock levels have historically returned rapidly. Two of the retailers experienced significant reductions in stock levels at the pandemic hit the UK, but two of the retailers did not see such an immediate challenge. All of the online retailers now carry less product lines which are in stock now than before the pandemic with only Retailer C demonstrating stock reduction before March 2020.

Following a few turbulent years of profitability challenges, the bike market’s big players may have actively chosen to reduce their stock levels in the face of broader sell through challenges. Notoriously, many large bike retailers that closed in the past five years did so with a warehouse full of aging stock in an over saturated marketplace.

Those retailers who saw significant falls in products available for fulfilment at the beginning of the pandemic should see stock levels return to circa 2018 rates in the spring of 2022 should the forecasts be correct. Once more, that all hinges on a very fluid set of circumstances returning to some sort of ‘normal’. Unavoidable price increases on goods may influence held stock levels to a degree on good landed.

Finally, each individual retailer experienced a different outcome with regards to stock levels in 2020, which would indicate that the retailer’s strategy effects the impact of supply and demand presented by distributors. Will the balance of stock levels have tilted with other retailers large and small placing bold bets now into MY23? Time will tell, but with forward orders broadly larger than usual and deeper into the future we might expect that when ‘normal’ returns that the market’s stock situation will once more show an abnormal spike, something that the industry appears to be wary of for fear we return to extreme saturation if demand does not meet optimistic forecasts.

Further articles for the cycles, parts and accessories retailer are available via the link.