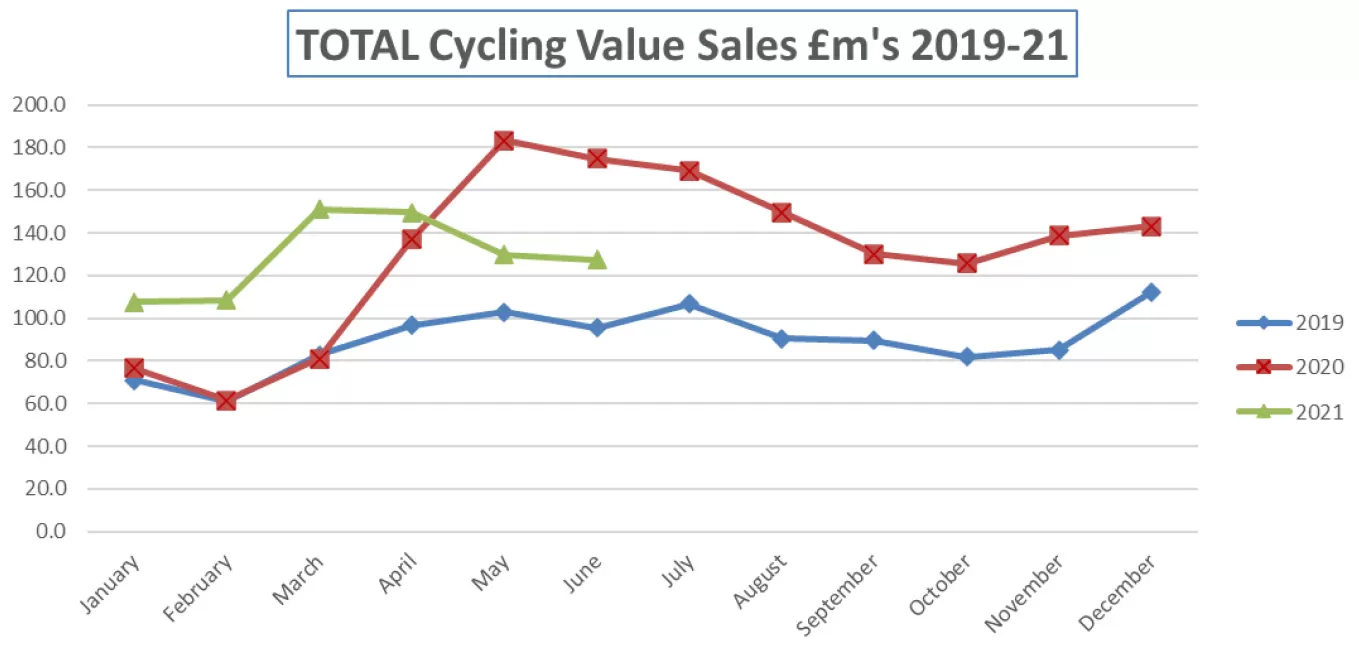

Following an exceptional year of growth in 2020, the Bicycle Association (BA) reports that, for the first 6 months of 2021, the total UK cycling market continues to show strong demand and has increased broadly in line with BA forecasts with value growth of +8% year on year (YOY).

This growth was driven by a very strong Q1 performance of +68%, annualising against a slow start in 2020, followed by an expected decline in Q2 of -18% as continued strong demand this year was offset by the sales boom which was unleashed by the first lockdown in 2020.

Comparing on a 2 year basis to a pre-pandemic 2019, both quarters showed strong value growth with Q1 +71% and Q2 +38%, evidencing a continued, strong underlying demand at +52% overall.

Simon Irons, BA Market Data Service Director, said:

“It is really encouraging that the demand for bikes, and all cycling products, remains strong a year on from the start of the pandemic. It seems clear from the data that some of the consumer behaviour changes we saw emerge last year are enduring and we are delighted that our market data service is enabling industry subscribers to understand the full picture almost within real time and adapt their businesses accordingly“.

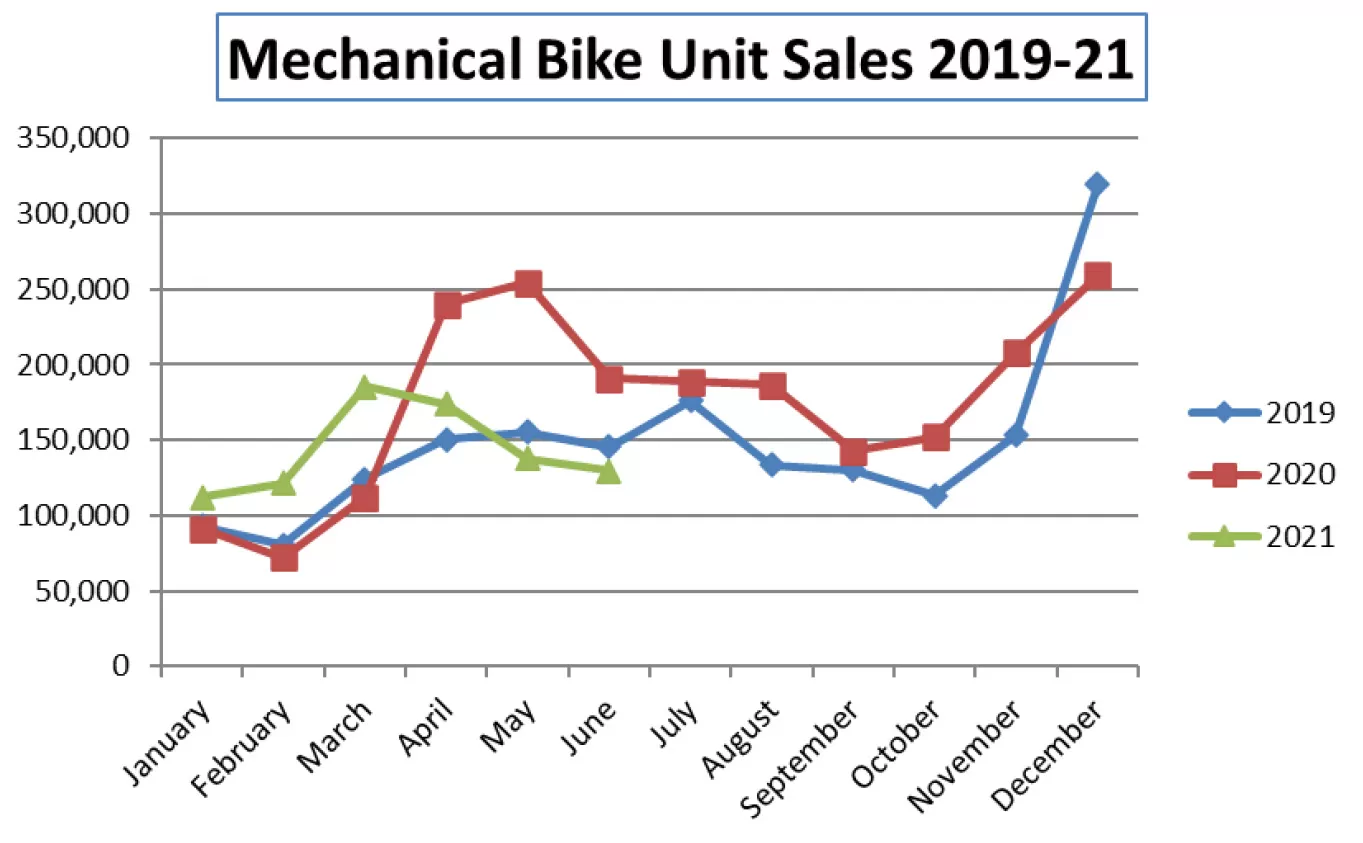

As expected, May and June 2021 figures saw a decline vs 2020, down -29% and -27% respectively. However, the decline was greater than forecast with the comparison to extraordinary sales in the prior year compounded by poorer weather this year, especially during May.

Bike stock availability will have undoubtedly also played a role in not converting all of the strong demand into the full sales potential with bike volumes actually dipping below 2019 levels during May and June 2021.

Bicycle Association Category Highlights

All major categories have followed the same sales value trend YOY in the first half, although e-bike growth at +17% is outperforming mechanical bike value sales growth at +10%. Growth remains very strong compared to pre-pandemic levels with e-bikes +146% vs 2019 YTD and mechanical bikes +54%.

The service market, which includes workshop and hire business, is predictably in strong growth at +41% YOY , due to the negative impact of lockdown April to June 2020 as bike shops struggled to adapt to legislation and customers stayed at home.

The Parts, Accessories and Clothing (PACs) category has grown 4% YOY in the first half of 2021 but remains at +29% vs 2019 levels.

OUTLOOK

Whilst total market performance in the first half of 2021 has been broadly in line with BA forecasts, with the continued stock challenges the industry is facing, we now expect total value sales to be at, or slightly below, sales in 2020.

Even on this basis, 2021 sales should finish strongly ahead of 2019 with growth between +30 and +50%.

As cycle retailers continue to strive toward ever better results, the personalisation of product selection for each consumer, is becoming ever more critical. In pursuit of greater revenues and sales the adoption of appropriate software becomes ever more essential to retailers going forward.

Further articles for Cycles, Parts and Accessories is available via the link.