The food and beverage sector has found its sweet spot when it comes to maximising the potential of digital and of online sales. With more online grocers joining and succeeding in the market (and the Amazon Effect making the e-commerce landscape even more competitive), it seems due time for wineries to follow suit. However, with regulatory and logistical challenges still posing a big obstacle for wine e-commerce and digitisation across the industry, this has largely not yet been the case.

According to Cision, “if online grocery sales continue growing as projected while alcohol retailers underperform at the same rate [they have been, businesses in the wine industry] could lose out on $1.68 Trillion By 2025“.

An e-commerce solution, along with the embracing of digital disruptors and technological innovation in the wine industry, maybe a panacea for wineries as well as for wine manufacturers and distributors. The question that remains is: how can these businesses tap this digital opportunity, and when will they do so successfully?

The top 3 challenges for online sales in the wine industry

In the US, online wine sales will grow from 5% to 20% within 5 years (only a fraction of what’s being sold in other countries across the globe). Why? Because most wine businesses have not yet figured out how to sell (and fulfil orders) online in a way that’s simple, convenient, and profitable. Given the major hurdles on the path to success, it’s not a surprise that businesses in the wine sector are still adopting wine e-commerce extremely slowly. Here are the leading challenges:

- Alcohol laws and regulations vary from state to state in the US – this restricts the transportation of wine to consumers and makes logistical challenges even more of an issue.

- Managing order fulfilment online becomes complicated with these regulatory constraints and additional factors like temperature control requirements paired with consumers’ growing demand for next-day and same-day delivery.

- The last mile of delivery is a particularly tough barrier across the industry, attributed to the need for ID verification and challenges associated with weather-related hiccups. While a large group of startups are dedicated to solving this issue, the industry has failed to perfect the last step of this process so far.

Why capitalise on digital innovation in addition to wine e-commerce?

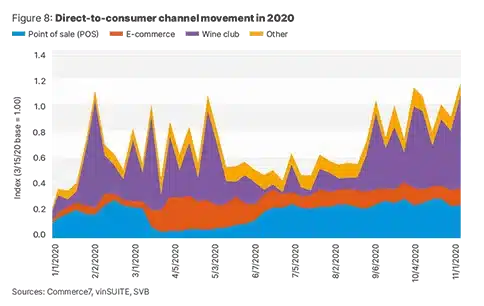

The reasons for investing in digital in the wine industry are numerous. While wine e-commerce is a big part of the equation, there are also wine-centric apps on the rise, D2C sales skyrocketing, and emerging technologies impacting distribution, last-mile delivery logistics, and more.

Here are a few of the most notable opportunities in the industry right now.

1. Technical innovation is everywhere, but not enough businesses are adopting it

Technical innovations across production, sales and delivery, product recommendation and personalization, and consumption are just beginning to take over. Some businesses are testing things like sensors with predictive models to assist vinification and wine ageing, algorithms to match customers with products based on their preferences and taste palettes, and packaging innovations including boxed, canned and single-serve formats for wine.

Although delivery services centred around getting wine at your doorstep makeup around 40% of the wine industry’s movement toward innovation, there is limited space to make improvements — and only addresses part of the problem.

The obvious next step would be to continue to improve delivery and fulfilment services while keeping our eye on how we can take better advantage of opportunities for disruption in production and personalization. Although there is much room for improvement when it comes to digital innovation, the industry has established the foundation and first steps to embracing technology.

2. Customer demand is setting a new bar for digital success

The U.S. is currently the largest market for wine in the world (consuming about 13% of the worldwide supply), which allows the American customer base to significantly impact trends in the industry.

In the U.S., wine has a much higher market share compared to other spirits when it comes to online sales, and it’s making wine e-commerce a necessary part of digital strategies for the wine industry rather than just an option.

Emerging technologies continue to improve direct-to-consumer (D2C) sales of wine to meet the fast and unrelenting rise of customer demand.

According to a recent Silicon Valley Bank report, the success of the wine industry online will continue to rely heavily on customer-centric approaches. As quoted in the report, “Successful wineries 10 years from now will be those that adapted to a different consumer with different values — a customer who uses the internet in increasingly complex and interactive ways… Successful companies will be those that evolve retail strategies away from the winery location as the sole point of experience and find other, scalable means of delivering the experience — and the wine — to consumers where they live.”

This has already been proven true and is already impacting the market. We see disparities in how consumers buy wine online, based on whether or not — for example — they live in urban or suburban neighborhoods: the former being more likely to purchase for same-day delivery and the latter more likely to order in-app for in-store pickup. Businesses must be privy to and cater to, customers based on preferences like these to fully lock in the opportunity in online sales.

3. D2C sales are the avenue for excellence (especially for small businesses)

Direct-to-consumer (D2C) sales in the wine industry are through the roof. The D2C wine sale market brought in $3.1 billion in 2017 and is on target to reach $5.2 billion in 2022. Currently, 62% of wineries consider D2C to be their fastest-growing sales channel;, while it makes up less than 10% of total sales, it makes up an estimated 20% of total profit. Across the supply chain, e-commerce has made direct-to-consumer sales an opportunity for organizations to tap.

For small businesses, this opportunity is even more significant. According to the same Silicon Valley Bank report, small wineries’ gross margins are doubled by selling direct-to-consumer.

The D2C trend in the industry shows no sign of slowing any time soon, and will only continue to grow as more businesses emerge and disrupt the market with new ideas and technology.

4. The e-commerce market isn’t yet cornered

When it comes to online wine sales, we’re miles from where we could be (especially in the U.S.). Currently, the top 20% of wineries selling through websites are responsible for 90% of revenue flowing through the channel. But this doesn’t mean there is no room for competitors to shake up the game.

In 2019, so few businesses in the wine industry are getting online sales right, that players who are simply participating in wine e-commerce at all are getting a massive piece of the revenue pie. Now imagine your business entered the market with a fool-proof strategy focused on convenience and customer-centricity; a significant piece of that pie could be yours.

Here are some notable industry success stories to learn from:

- Industry leader, Naked Wines, says revenues have grown by 80% in the last six months, and D2C sales with businesses like Winc are seeing major success.

- A leader in wine delivery services, Drizly, saw its revenue grow by 61.8%.

Your business can be the next success story, or the next cautionary tale, depending on how you approach your digital strategy.

5. Wine e-commerce web stores are decades behind UX expectations

Among the businesses in the wine industry that do have a web store or online presence, many seem to be doing the bare minimum, and it’s obvious. A summary of what the web store experience looks like today is perhaps best summed up by Silicon Valley Bank’s report:

“Few wineries have an online presence that engages the customer. Sites lack sophisticated, responsive, fully integrated designs and experiences that allow new and returning customers frictionless e-commerce.”

“The opportunity,” they say, “is wide open for a company using online tools to replace the distributor’s sales and marketing role [and using] big data to enhance outreach to consumers and improve sales opportunities.”