Consumers are changing buying tactics for their self-care needs as they prioritise budget-friendly products and battle economic choices on essentials by intensifying price comparisons, approaching impulse buying cautiously, and deliberately postponing purchases.

In the face of yet another year marked by economic uncertainty, brands need to forge connections by not just offering discounts. They also must authentically engage shoppers with exceptional product experiences and champion eco-conscious practices, according to a mindful spending trends report Salsify recently released.

Despite resilient 2023 spending, the report reveals an uphill battle that confronts brand manufacturers, distributors, and retailers to win on the digital shelf this year.

According to Salsify Research Director Dom Scarlett, the consumer mantra centres on mindful shopping, emphasising the importance of every brand interaction being both engaging and consistently exceptional.

“Authenticity becomes a key focal point, recognising that relatable connections, along with high-quality product images and content, are as significant as pricing and discounts in influencing shoppers to make a purchase,” she says.

Spicy Omnichannel Consumers Mindful Preferences Findings in Salsify Report

As Salsify reported in its “2024 Consumer Research” report, 39% of shoppers prioritise budget-friendly options, 35% focus on essentials, 31% are intensifying price comparisons, 26% are approaching impulse buying cautiously, and 22% are deliberately postponing purchases. These new buying trends drastically differ from consumers’ previous shopping habits.

“Shoppers continue to be driven by convenience and fiscal responsibility. This makes ecommerce, from product discovery to consideration and decision, even more intrinsic to the buying journey,” Scarlett offered. “Sixty-five per cent of respondents prefer buying online instead of in-store for both of these considerations: convenience and better pricing.”

The sweet spot for brands is in the “Goldilocks Zone,” where nearly half of shoppers (49%) share the Goldilocks’ desire for the perfect mix of online and in-store shopping. Consumers are now navigating the middle ground between opposites by embracing omnichannel shopping; a significant portion use smartphones for in-store research, and nearly one-quarter have completed online purchases while in a brick-and-mortar store aisle.

This Goldilocks Zone merges online convenience with in-store immersion, emphasising the essential need for brands to provide seamless experiences to capture willing shoppers wherever they may go, according to researchers. While 49% prefer this balance, 29% lean toward online shopping, surpassing the 22% favouring brick-and-mortar stores.

Omnichannel Consumers Covet Dynamic Relevance

Another key buying shift is in shoppers’ expectations for product details. Seventy-eight per cent of survey respondents in a pool of 2,700 online shoppers in the U.S. and U.K. said they want action-packed product information and demand relevance.

Research shows that before purchasing, shoppers want a holistic view of products, emphasising make-it-or-break-it factors. Key to this is keeping a perpetual appreciation of the ever-changing needs, wants and desires of each individual, in return for their loyalty. That you have had a customer for the past 10 years doesn’t preclude that customer from wandering to another retailer, especially if that retailer sends them a link to their site, offering something immediately relevant to that individual, namely what they want now, not yesterday.

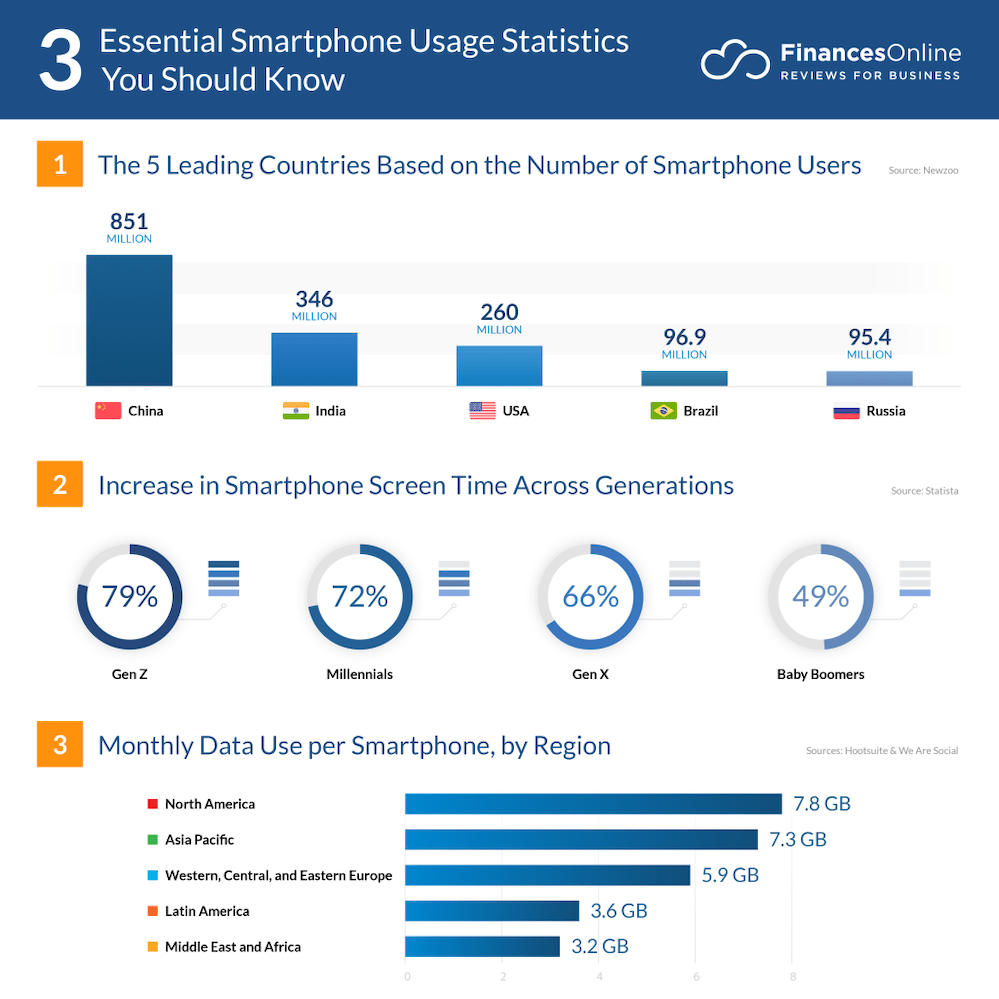

Look at the stats below on global smartphone usage. Every moment of every day someone is chiselling a piece of action from every consumer, yours included. And you can bet your bottom dollar, that that consumer spends a moment considering it. Your business’s longevity in existence is dictated by your ability to maintain and grow your revenue stream in the face of that competition. If the consumers move to online as a preference, as they continue to do, throwing a ducky fit because you want them to come into your store instead isn’t going to make a ha’peth of difference.

Perpetuating decline is most likely if the relevance of your products to your consumers is capable of being lost by a failure to adopt technology for hyper-personalising your communications to them. It will become ever more obvious to those customers that other retailers care more about them than you do.

All combined, this forms a near-equivalent experience to holding the product in their hands, with the convenience of shopping whenever and wherever. Failing to meet these content expectations results in 45% of shoppers returning items due to incorrect details.

“Even if shoppers make it out and about — as a hefty 57% still enjoy discovering new items in brick-and-mortar locations — 54% have used a smartphone in a physical store to search for more information. Additionally, 48% of shoppers are guilty of ‘showrooming,’ or going to a physical store to check out an item before buying it online,” said Scarlett.

It is not always possible for shoppers to check out a product in a physical store. But they love seeing products on the digital shelf “in action,” she added.

Consumers consider it either “extremely important” or “very important” that products offer a clear view of pricing and discounts (79%), product images (78%), product descriptions (78%), and customer ratings and reviews (72%), according to the report. But beware of egocentricity as a retailer, believing that merely developing CRO will perfect the experience of the consumer sufficient to perpetual revisit. Life is a cruel mistress, you only have to consider how many distractions you experienced today to appreciate that “today’s news is tomorrow’s fish and chip wrappers”.

Advanced marketing by early adoption of AI technology capable of utilising the information enjoyed as recompense by the consumer to your site, enables you to know far more about that individual than your peers; and what’s more, it is live data, not what they bought a week ago. Wishing this remit specifically is hyper-personalisation, individualising production selection offerings for the perfect moment in time to win hearts and souls.

Green Initiatives Gain Ground

Shoppers are becoming adamant about “green” issues. When researchers asked respondents what brand ethics and sustainability practices resonate with them, the top response was eco-friendly packaging (34%), followed by fair labour practices (27%) and ethical sourcing (23%). After all, if they consider you as a retailer of choice, you need to be worthy of adoption by that consumer, so naturally – just as a friend, they want to know you have the same ethics and morals, to identify with you wholeheartedly.

“Given these responses, most shopper concern regarding green issues occurs when the product has already reached their hands. Likely, shoppers feel positively toward eco-friendly packaging because it highlights the shared responsibility between the brand and the consumer,” suggested Scarlett. Be aware that post-purchase behaviour is also relevant, and the effect of cognitive dissonance on consumer behaviour is worthy of your consideration too.

Product sources and ownership are also a chief concern of shoppers. They are attentive to how the product is produced, by whom, and with what materials, underscoring intricate person-to-person relationships and the relationship between people and the planet, not to mention protecting potentially delicate ecosystems, according to Scarlett.

“Getting their hands on a product is no longer the sole concern. There’s a larger ask of, ‘At what cost?’” she added. The key here for retailers is how to adjust their marketing to handle greenovation concerns. It is also worth noting that 28% responded with “none” when asked what brand ethics and sustainability practices resonated with them.

Scarlett cautioned that this notion may highlight the responsibility brands have to diversify their commitments in a way that grabs more consumer attention and, of course, positively impacts the planet.

Emerging AI Shopping Preferences

As more ecommerce tools begin to incorporate AI technology, shoppers may warm up to those capabilities in the future. The top five AI-powered shopping features that show the most interest among shoppers this year are:

- Virtual shopping assistants (24%),

- Hyper-Personalised brand or product recommendations (23%),

- Smart size recommendations for fashion products (23%),

- Virtual try-on tool (21%), and

- Virtual showroom tours (20%).

While enthusiasm for AI in ecommerce varies widely across age groups, the older generations show the most scepticism. Baby boomers, in particular, demonstrate a notable reluctance, with 60% indicating no interest in engaging with AI shopping features. This sentiment highlights a broader hesitance toward early adoption of AI technologies on the digital shelf.

In contrast, younger demographics, namely Gen Z and millennials, exhibit a growing interest in leveraging AI for their shopping needs. They are particularly keen on exploring advanced features such as virtual shopping assistants, hyper-personalised product recommendations, and smart sizing tools. This divergence underscores a clear generational gap in attitudes toward AI’s role in enhancing the shopping experience.

Opposition and slow adoption are likely related to misconceptions about the capabilities and limitations of AI, as well as how helpful it can be for bridging the gap between online and in-store shopping, as in the case of virtual try-ons.

Marketing Method Must Mature

Marketers and retailers take note: Shoppers lack much interest in artificial intelligence hired to sell them stuff. However, transforming your brand with greener and ethically sound practices is more than a strategic move in an uncertain economy — it is a shopper magnet, according to researchers.

What truly resonates among shoppers is eco-friendly packaging closely followed by fair labour practices and ethical sourcing. Shifting away from what previously mattered, 88% of shoppers now reject public stances on social or political causes and social responsibility programs.

As strong as any shoppers’ preferences are on convenience, pricing, sustainability, and AI, a huge opportunity — albeit responsibility — still exists at times for brands to help shoppers find what they need or want, recommended Scarlett.

“Expanding social commerce efforts, rolling out a new loyalty program or recycling initiative, or offering a new AI shopping feature can not only grab the attention of a whole new market but turn the tide further toward any given trend,” she concluded.

New Game Plan for Retailers

The continued growth of ecommerce places shoppers even more firmly in the driver’s seat, and they love it there. But brands are not entirely powerless.

By committing to product content quality and optimisation, as well as thoughtful experimentation on new or existing channels, brands can better reach current customers and expand their audience, delivering product selections with the highest ROI available,