Alongside the surge in online shopping comes a much less desired activity for retailers: returns. While many retail brands have seen increased sales as a result of online shopping, a significant amount of these sales are being affected by excessive returns.

In the U.S. alone, consumers returned $351 billion of all online and offline purchases last year. Online purchase return rates also tend to increase considerably during holiday periods.

The impact of this is profound. Excessive shopping returns can affect profit margins drastically, and often requires additional resources, such as staff and space, to manage the high volume of returns. But just how common are online shopping returns? Why are consumers making them? And what can retailers do to reduce the rates of returns?

Online shopping Return Rates are Creeping Up.

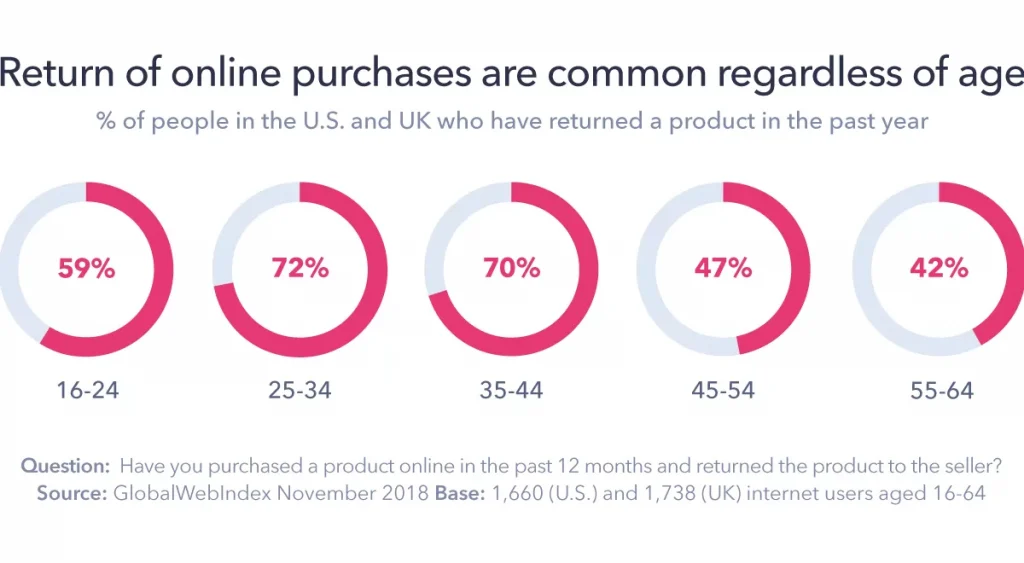

Years ago, free shipping or returns were more of a nice-to-have. Nowadays, free shipping and easy or free returns are increasingly expected by consumers. Latest data shows that almost 3 in 5 people in the U.S. and UK have returned a product they purchased online in the past 12 months.

People aged between 25-44 are more likely to have returned a product to the seller in the past year. However, older generations are also returning products at a notable rate, with over 40% of people aged 45-64 doing so in the past year. Information about online shopping returns is something that consumers actively seek.

This behaviour is quite consistent across generations. This shows that online shopping returns is an issue that consumers carefully consider before they commit to buying a product, across all age brackets. As a result, a well-thought-out returns policy is a key part of a brand’s value proposition and essential in remaining competitive.

Online shopping returns are more prevalent than in-store returns.

Our data shows over half of online consumers are more likely to return a product they bought online than a product they bought in-store. This behaviour is more common among younger audiences and is likely partly due to online retailers’ generous delivery services and the ease with which consumers can return products online.

Returning a product in-store also tends to require more effort from consumers as they need to travel to the store and face the stress of queues. There’s also the potential embarrassment factor of making lots of in-store returns. Generous delivery services play a significant role in the surge of online shopping returns. Our data shows that 70% of people in the U.S. and the UK pay for a free delivery subscription provided by online retailers, as Amazon Prime.

Retailers can help reduce faulty or damaged products reaching consumers by using good-quality packaging and partnering with reputable shipping companies. Incorrect sizing and fit is a big problem for clothing brands in particular. The big drawback is that consumers can’t try on an item before making a purchase, and therefore don’t know if it’s right until they receive it. A serious cost driver for retailers is consumers buying from retailers while knowing in advance they’re likely to return the item.

Online retailers have made it so easy for people to return products that consumers are increasingly taking advantage of it. To top it off, The National Retail Federation reported that fraudulent returns cost retailers as much as $15 billion in the U.S. in 2017. A common example of return fraud is when consumers buy an item, wear it and then return it to the seller.

Brands like Amazon are stamping down on consumers who they feel are making excessive online shopping returns and are closing users’ accounts. It’s likely other companies will follow suit. Online shopping returns are part and parcel of doing business online, and consumers say free returns (56%) is a key feature that would motivate them to make a repeat purchase online.

If brands don’t offer free returns, they risk being shunned by consumers. After all, the availability of free returns is a big incentive to buy, and there are plenty of alternatives out there for consumers to choose from. However, not all brands are willing, or have the financial capacity, to offer free returns. We already know Amazon has had a seismic effect on the retail industry, and the company often faces heavy criticism for its impact on small businesses.

Lately, Amazon has paid specific attention to smaller businesses. It recently announced Storefronts, a new section on Amazon’s marketplace where consumers can shop for products exclusively from small and medium-sized businesses. This presents opportunities for small businesses to work with Amazon and make use of its extensive distribution channels and global exposure. Amazon will pick, package and ship the products and will also take care of customer service and returns.

The good news for brands is free returns aren’t the only motivator for consumers to make a repeat purchase online.

Hyper-personalisation becomes mission-critical

While all the surveys in the world identify obvious solutions, all of which have been known and appreciated for quite a few years, the new darling of ecommerce – hyper-personalisation, has a less understood or appreciated benefit – minuscule return rates. But it is biding its time, and mark our words – the next few years will see increasing appreciation and euphoria on this specific issue. If you offer predictive personalisation of product selection you are showing the consumer products that have already been identified as those they want to buy, hundreds of times more than items merely sitting on a proverbial shelf of an ecommerce page or social commerce site.

This isn’t a fad choice. This isn’t an “I’ll bung it on at the end of my selection as I can always send it back, anyway“. These are products already identified by impressions and purchase history of that individual consumer, therefore thousands of times more likely that they’ll love and want, as dictated by their prior actions. Who returns a puppy?

Hyper-personalised product selection solutions, using AI machine learning algorithms, identify consumers’ future behaviour by ranking every SKU by the greatest likelihood of that individual consumer purchasing from all the SKUs listed, in order of greatest propensity. It presents them to that individual at exactly the right moment, thereby maximising that individual’s customer lifetime value CLV potential. (i.e. Likelihood to Purchase, Discount Affinity, Likelihood to Churn etc).