The customer acquisition cost (CAC or CoCA) means the price you pay to acquire a new customer. In its simplest form, how to calculate your customer acquisition cost can be done by:

Dividing the total costs associated with acquisition by total new customers

Do not get this metric confused with cost per action (CPA), as there is a strong distinction between the two. In ecommerce, cost per action is typically the amount you pay to convert a customer (i.e. to make a sale), but this relates to both new and returning customers. CAC is all about acquiring new customers. See how even Google refers to CPA as ‘the cost you are willing to pay to make a conversion’ NOT to acquire a new customer.

Customer Acquisition Costs = Total costs / Total number of customers acquired

The importance of CAC in ecommerce

Ok, so we know what it is but why is it important? You’ve got a lot to do—how is this going to make you more money?

The cost of customer acquisition is one of the MOST important metrics for any ecommerce store, along with the lifetime value of a customer. Why? Because your store needs to make money. This means you need to get a return on investment (ROI) from your marketing and sales campaigns.

Aside: We have produced an advanced guide to customer acquisition to support this article.

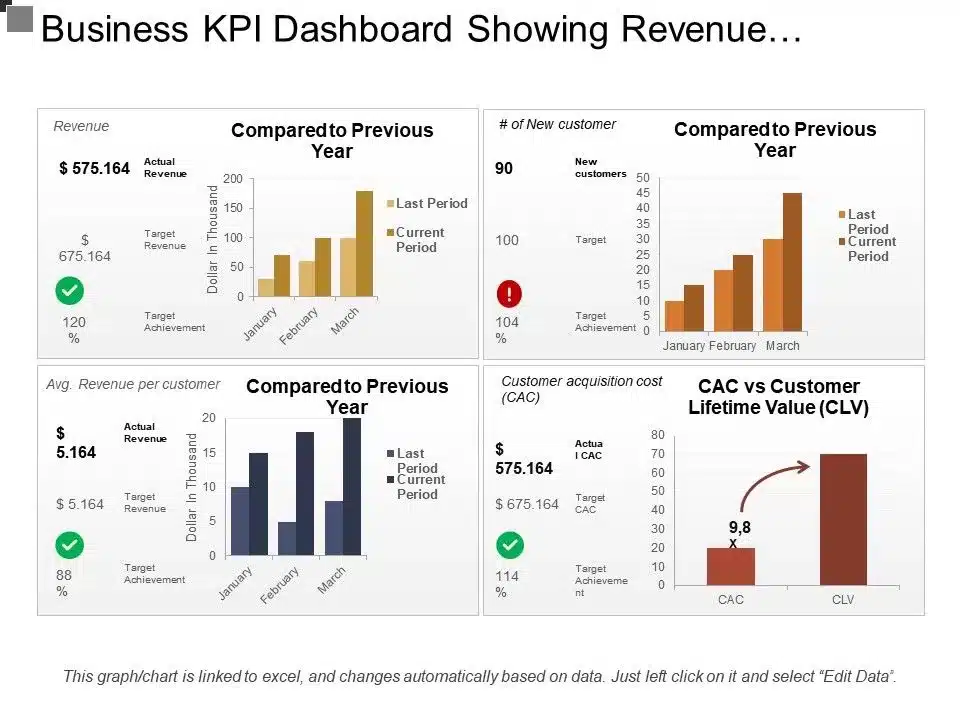

The importance ratio to focus on then is one that tells you exactly how much value you’re making from your customers about how much it costs to acquire them:

LTV (Lifetime Value): CAC

It’s as simple as this: your business will fail if your CAC is higher than your LTV. Let’s go through a few scenarios to assess what you should be aiming for with regard to the LTV: CAC ratio.

- Less than 1:1—you’re going to go out of business, and fast

- 1:1—you’re losing money from every acquisition

- 3:1—the perfect level. You have a thriving business and a solid business model

- 4:1—great news, but you’re under-investing and could be growing faster. Start more aggressive campaigns to acquire customers and bring your ratio closer to 3:1

As well as the above, you need CAC to assess how your marketing campaigns are performing. The goal is to find the marketing channels that have both a high LTV: CAC ratio and are scalable. There is no use only focusing all your time on channels that send only a very small amount of customers. Find the right balance between time/effort, LTV: CAC and quantity of customers acquired.

To summarise, there are two key reasons that CAC is very important:

1) Working out your LTV: CAC ratio and the months required to recover your CAC helps you analyse the overall health of your business. Figuring out the months required to recover CoCA is very useful in determining how strong your business model is. It’s no good if it will take three years to recover your initial investment because you need to reinvest that money. A great target to aim for is anything under 12 months.

2) CAC helps you optimise your marketing campaigns and channels – Where are you acquiring your best customers from? What channels and campaigns have the best LTV: CAC ratio? Remember that customer acquisition costs for different campaigns are not constant. They change all the time and you must be vigilant of this – when you stop getting an ROI then stop the investment.

How to calculate CAC for your ecommerce store

There are two methods for working out the cost of customer acquisition: a simple (but less accurate) way and a more complex way that involves many other variables.

Ultimately, there is only one correct way, which is a complex way. However, doing things the simple way is more useful than not doing them at all to get an idea of how different channels are performing in relation to each other. Be wary of using it when going over your LTV: CAC, as it misses out on a lot of key costs.

Where:

CAC = Cost of customer acquisition

MCC = Total marketing campaign costs related to acquisition (Not retention)

W = Wages associated with marketing and sales

S = The cost of all marketing and sales software (Inc ecommerce platform, Automated marketing, A/B Testing, Analytics etc)

PS = Any additional professional services used in marketing/Sales (Designers, Consultants etc)

O = Other overheads related to marketing and sales.

CA = Total customers acquired

We mention ‘sales’ above which, typically, tend not to be associated with ecommerce. However some companies may have a sales team to explore and close wholesale opportunities. You can see how the above equation takes into account all costs associated with acquiring a customer in a particular period.

Analysing by Campaign or Channel

If you want to analyse the cost of acquisition on a campaign or channel basis, then you’re going to have to start attributing things such as the proportion of time spent on particular campaigns or channels to work out the corresponding wages.

And what about problems with attribution, you say? There can be numerous campaigns and channels involved before someone makes a purchase. For example, someone may first visit through a Facebook ad campaign, not purchase, and then return through a retargeting campaign and purchase. How do you attribute the campaign costs associated with the acquisition?

To calculate this, just split each campaign into the costs that went towards attracting and converting returning customers and the costs involved in attracting and converting new customers. You then have the total cost associated with the acquisition from that campaign. To work out the total channel cost just add together the total campaigns associated with that channel. It is very useful to analyse what channels and campaigns are good at attracting or converting customers.

This can all easily get a bit messy. However, if you are spending a significant amount of money on these channels I would highly recommend taking the time to try and work this out. You may find out that a channel you thought was very profitable isn’t at all, or vice versa.