AI strategy change delivers enormous ROI. AI is a versatile tool that firms use to achieve a variety of business goals. When starting, companies tend to use it to automate internal processes, boost productivity, and increase staff and customer engagement.

As they progress and become leaders, they use AI to generate strategic gains. From an amalgamation of various studies, 31% of AI leaders report increased revenue, 22% greater market share, 22% new products and services, 21% faster time-to-market, 21% global expansion, 19% creation of new business models, and 14% higher shareholder value.

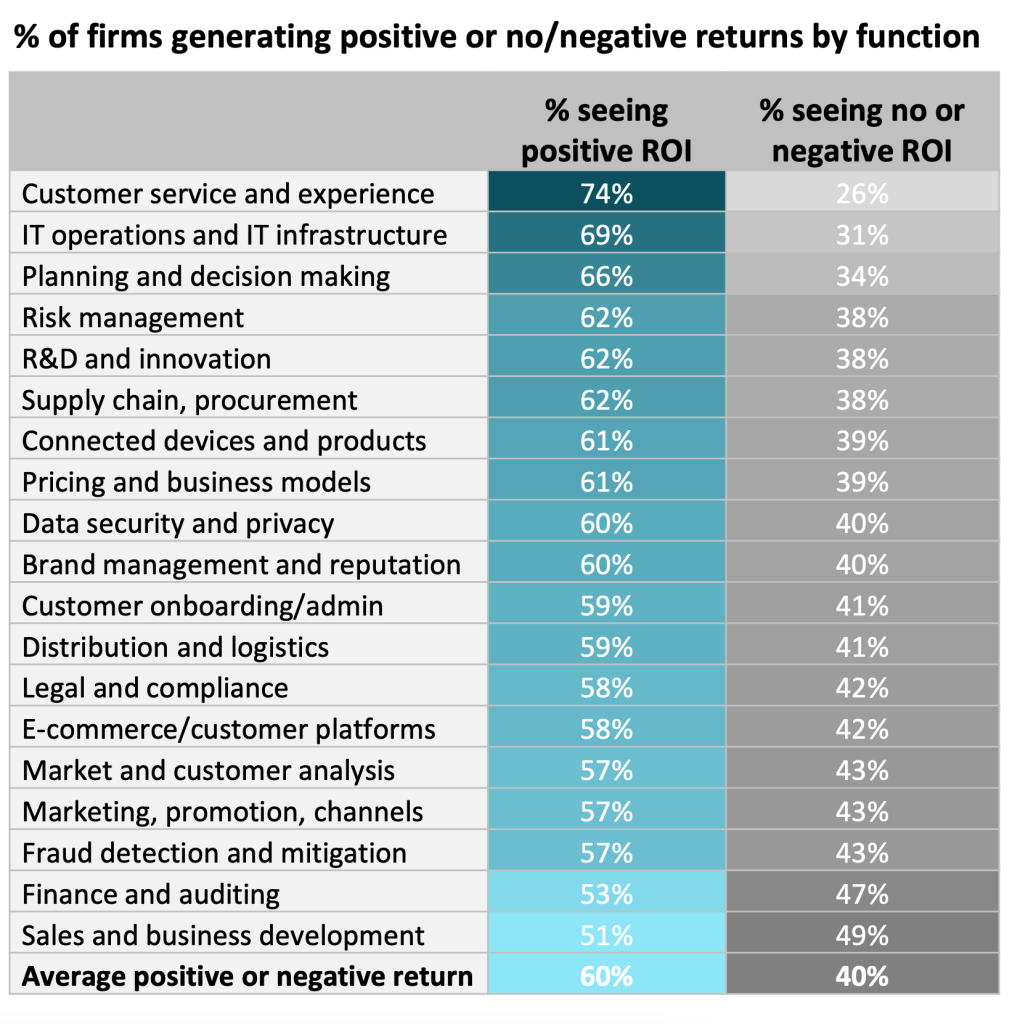

Most tellingly, the AI-enabled functions showing the highest returns for companies are all fundamental to rethinking business strategies for a digital-first world: strategic planning, supply chain management, product development, and distribution and logistics.

Over the next three years, more than twice as many firms as today plan to implement AI strategic change across their businesses.

During this year 63% of firms are maturing or advanced in their adoption of AI. In industries that are earlier in their AI journey—such as insurance, wealth management, and media and entertainment—the increase will perpetuate.

The number of firms proficient in using various AI technologies will also jump over the next three years: for RPA it will climb from 29% today to 68% by 2023; chatbots from 25% to 59%; computer vision from 13% to 22%; machine learning, from 19% to 45%; and deep learning, from 11% to 20%.

With the success of AI being dependent on data, 73% of companies plan to be maturing or advanced in data management, up from about 37% today. Firms will also leverage more types of data by 2023, with the use of psychographic data rising 109%, competitive 76%, geospatial 76%, real-time 75%, and social media 60%.

Executives should prepare for the challenges along the way.

Companies face three sets of common AI challenges: (1) coping with regulatory, ethical, and data security risks; (2) project and talent management; and (3) data and technology limitations. These hurdles can be large or small, depending on where a company is on its AI journey.

For example, limited AI skills, lack of adequate IT infrastructure, and data access and quality issues are often major barriers for AI beginners, while preparing and integrating data, managing risks and ethics, and embedding AI into day-to-day business processes become more daunting as companies scale AI across their organisations. At 45%, project management is the top barrier cited by firms, followed by managing AI risks (44%) and regulatory constraints (42%)

Are you a leader or a laggard in AI?

A prime objective of this research was to determine what constitutes an AI leader. To answer this question, we assessed firms along two key dimensions: the level of AI implementation and the benefits from AI investments. Here is what we found.

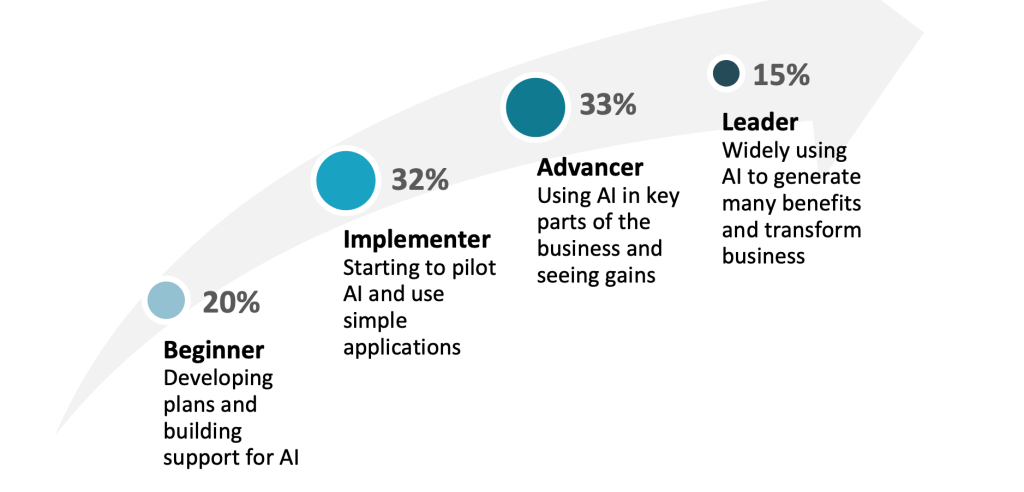

Slightly over half of the surveyed companies are in the early stages of AI development, either a beginner or implementer. Leaders account for 15%, while 33% of organisations (advancers) are right behind them, reflecting the rapid growth of AI.

% of firms along the AI maturity curve

How does your industry stack up?

Automotive firms and banks are ahead in AI, with healthcare not far behind. Wealth management and media firms are trailing.

With huge revenue bases and exploding use of AI to enable driver-assistance, telematics, and voice recognition systems, automotive is among the most advanced sectors in AI. Cars are becoming “sophisticated computers on wheels,” according to Elon Musk, CEO of Tesla, which is planning to roll out a fully self-driving car at the end of 2020.

But the auto industry’s edge in AI goes beyond smart cars. Automakers invest a lot more than others in all aspects of their operations. They employ bigger AI teams, have more AI projects in place, and use a broader mix of AI technologies—ahead of others, for example, in RPA, machine and deep learning, and NLP. Reflecting their commitment, automakers’ AI budgets averaged about $59.4 million last year, the largest of any industry. Automakers spent $13.4 million more than banks and $11.7 million more than technology companies. Automotive executives are more likely to see AI as critical for their industry’s future: 77% vs. 64% of others.

Banks are also well ahead in AI. With fintechs nipping at their heels and customers pushing for fuller digitised experiences, banks are scrambling to harness their rich data troves through AI. Yet investment management and insurance firms, which have as much to gain as banks, are still behind. They are held back by staid cultures, and in the case of wealth managers, an entrenched bias for personal contact.

Gearing up for the age of algorithms

The number of companies that expect to be maturing or advanced in AI will more than double over the next three years. For some industries, the number will leap more than fourfold.

Firms in our sample say they invested a total of £46 billion in AI last year, and they intend to increase spending by 8.3% per year on average over the next three years. While the economic fallout from COVID-19 may cause them to reduce this figure, companies across industries are still likely to meet their goals to become more sophisticated in AI usage this year.

The most spectacular progress is expected among industries still in the early stages of AI maturity but where AI leaders, such as Netflix and Amazon, are showing the way. These include investment management, insurance, media, consumer/retail, and energy. Most will catch up in AI development, except for investment and media, which will stay considerably behind.

Company size will continue to drive maturity. Firms with revenue over £20 billion have the greatest number of leaders at present and nearly all expect to be advancers and leaders in three years. Firms between £1 billion and £4.9 billion and those between £5 billion and £19.9 billion are now behind their larger peers but plan to make substantial progress.

The smallest companies have much weaker ambitions, which could hurt their performance in a data-driven business world.

Firms will use a wider array of data

IoT, customer, and internal information are now the main types of data integrated into AI applications. This year, companies will use AI to generate insights from wider and more diverse sets of data.

One of the reasons why companies focus on IoT, customer, and internal data for AI initiatives is the sheer volume of accessible data generated in these areas. Most other forms of data are used less. Yet that is where the greatest insights often lie, particularly when such data are combined.

Over the next three years, organisations will broaden their use of different types of data to take full advantage of what AI can do. Companies will double their use of psychographic data and rachet up their reliance on competitive, geospatial, and real-time data by around 75%.

Firms are spending more to narrow the gap with AI leaders

Companies increased their investments by 4.6% on average over the last year. Over the next three years, they plan to up their investments by 8.3% per year.

Firms in earlier stages of AI expect to double their AI investment—from 4.4% over the last year to an average of 9% annually over the next three years. Leaders expect to trim their growth in AI investments—from 6% over the last year to an average of 4.5% over the next three years. Yet since leaders are spending 2.6 times others in absolute dollars, non-leaders will fail to close the gap.

All industries in our survey plan to hike their AI spending over the next three years at a faster clip than last year. On average, they plan to raise spending by 1.8 times last year’s rate. Some sectors plan to ramp up spending at more than twice the rate of last year—media, investment management, and consumer and retail.

Budgetary pressures from the pandemic may moderate these expectations. Nonetheless, firms remain likely to boost their AI spending to find new efficiencies and to stay agile and resilient—which will be crucial if the health crisis persists and the economic fallout continues.

ROI increases with AI maturity

AI will revolutionise business. But it will take expertise, scale, and time to reach its full potential. Firms should be planting the seeds now, including building systems for measuring and tracking results.

While about two-thirds of senior executives believe that AI is important for the future of their business, the average return on all AI investments by company* is only 1.3%. Leaders do better, with an average return of 4.3%, but that still pales against returns on other corporate investments. That begs the question: Is the buzz around AI justified?

The answer is yes, but only if you have patience. Our research shows that corporate returns on AI bloom as companies become more advanced in AI. AI beginners and early implementers essentially show flat results. It is not until firms start to use AI more widely across their enterprises that the ROI starts to grow. With high upfront costs in data preparation, technology adoption, and people development, it takes scale to reach break-even and then eventually earn significant returns.

It is still early days for most companies: only 20% of AI projects are in widespread deployment, and among AI underperformers (those showing negative or no returns), the number of projects in widespread deployment is half that. Even among AI overperformers (firms with over 5% ROI on AI), only 28% of AI initiatives are in widescale deployment. The rest are still in pilot or partial deployment stages.

Which use cases drive the highest ROI?

Take away

Like it or not AI is here to stay, and to offer you an appropriate analogy it’s not a case of the train leaving the station as much as everyone clambering to get on an extremely busy motorway. The flow will be continuous and perpetual, it’s merely a matter of when you start, that will dictate the rapidity of your growth, and most importantly ROI.